Cornhusker Economics March 22, 2015Cooperative Patronage Refunds and Equity Management

Agricultural cooperatives must frequently make decisions about how best to apply the net earnings they receive from business with their members. Net earnings can be used to pay cash patronage refunds, accumulate equity capital for growth, or retire equity certificates held by current and former members. These uses of net earnings compete with one another, and all depend on the cooperative's rate of return on equity. If a cooperative increases one use of its earnings, it must either decrease another or take steps to improve its rate of return.

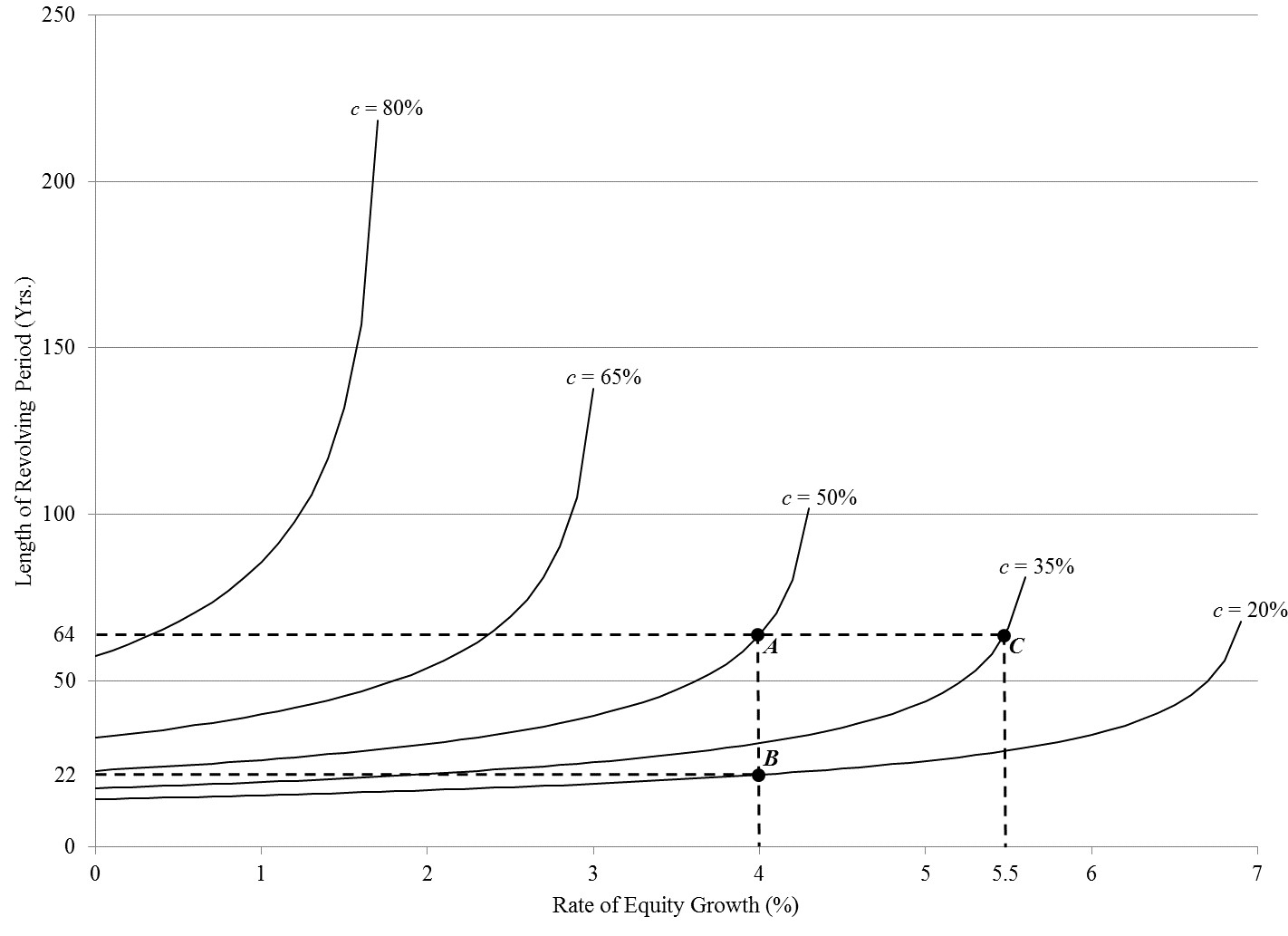

The proportion of patronage refunds a cooperative can pay in cash, the rate of equity growth it can maintain, and the length of its revolving period can be related to each another and its rate of return on equity according to a set of mathematical relationships. Figure 1 represents those relationships in graphical form. It shows the trade-offs between the rate of growth and the revolving period a cooperative can maintain given various levels of cash patronage refunds (c) and a 20 percent rate of return on equity. For any particular level of cash patronage refunds, the revolving period increases as the growth rate is increased. Moreover, the revolving period increases more rapidly as the proportion of patronage refunds paid in cash is increased. For a cooperative that pays 80 percent cash patronage refunds, even modest increases in growth necessitate substantial increases in the revolving period.

From the figure, we can see that a cooperative that earns a 20 percent rate of return on equity could pay 50 percent cash patronage refunds while maintaining a 4 percent rate of equity growth and retiring equity according to a 64-year revolving period (point A). Alternatively, it could reduce its revolving period to 22 years by lowering cash patronage refunds to 20 percent (point B). Or it could increase its growth rate to 5.5 percent by lowering cash patronage refunds to 35 percent (point C).

Although all combinations of cash patronage refunds, growth, and revolving periods represented in the figure are feasible given a 20 percent rate of return, the present value of the patronage refunds members receive can vary substantially. For example, assume members discount noncash patronage refund allocations at 10 percent per annum over the length of the revolving period. If the cooperative were to pay 50 percent of patronage refunds in cash and retire the noncash portion at the end of the corresponding 64-year revolving period (point A), the present value of the cash and noncash patronage refunds would be about $50. The present value associated with 20 percent cash patronage refunds and a 22-year revolving period (B) would be only about $30. In terms of present value, the additional cash patronage refunds at A more than compensate for the longer revolving period.

Because both A and B are feasible and the present value associated with A exceeds that of B, it might seem that the cooperative could increase its members' welfare by moving from B to A. However, a move from B to A would not make members collectively better off. Each year, the cash a cooperative has available for distributing to its members is equal to the difference between its net earnings and the funds it sets aside for equity growth. This cash can be distributed as cash patronage refunds or used to retire equity certificates allocated in earlier years. Moving from B to A will affect the present value of the cash and noncash patronage refunds allocated in the current year, but it will not change the amount of cash the cooperative has available for distribution. By increasing the proportion of patronage refunds it pays in cash, the cooperative will reduce the cash available for retiring equity certificates. The increase in cash patronage refunds will benefit current members, but only at the expense of older and former members who may hold substantial amounts of equityAlthough a movement from B to A will not alter the collective welfare of members, the choice of a point in Figure 1 is still of great importance. Increasing the level of cash patronage refunds can help current members avoid negative cash flows due to income tax. By maintaining a relatively short revolving period, a cooperative can ensure that the equity of older and former members is redeemed in a timely manner, thus maintaining the ownership of the organization in the hands of those who benefit from it. Finally, a cooperative may need to accumulate equity at a rate that ensures adequate growth and expansion of services. Selection of the point that is best for the cooperative and its members requires that the decisions regarding these variables are made in an informed and equitable manner. If the cooperative's goals with respect to these variables cannot be satisfied, it may need to explore opportunities for increasing its rate of return.

Jeffrey S. Royer, (402) 472-3108Professor, Dept. of Agricultural Economics

University of Nebraska-Lincoln

jroyer@unl.edu