U.S. Beef Trade Disruptions

Many factors impact beef trade, such as environmental, economic, social, biological, and government regulations. Consequently, changes to these factors can lead to substantial disruptions in trade. One notable disruption to the U.S. beef trade market was the discovery of the first case of Bovine Spongiform Encephalopathy (BSE) in the United States. A more recent (and ongoing) trade disruption has been the use of hormones and beta agonists in U.S. cattle production. The following article discusses these issues and their impacts on U.S. beef exports.

BSE was first discovered three decades ago and has substantially affected the world beef industry. The disease is carried in the brain and venous tissue of cattle and is linked to the fatal human variant Creutzfeld-Jacob Disease. The first case was located in the United Kingdom in 1984 although it was not officially identified as BSE until 1986. In 1987 evidence was found that BSE could be transmitted through the practice of feeding meat and bone meal (MBM) to cattle. As a result of international concerns, the United States Department of Agriculture (USDA) implemented a tracking practice in 1990 to monitor imports and a formal policy restricting high-risk products from being imported from countries known to have BSE (Coffey et al. 2005). The Food and Drug Administration established a ban on all high-risk mammalian products to be included in feed ingredients by 1997. In May, 2003 a BSE case was reported in Alberta, Canada and the United States responded by banning all imports of live cattle from Canada.

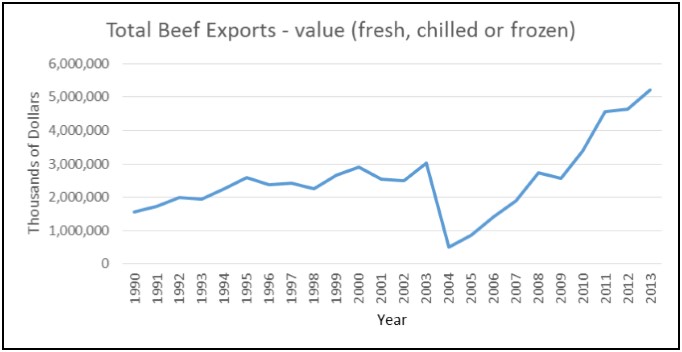

On December 23, 2003, a dairy cow in Washington State tested positive for BSE. The cow was quickly discovered to have been from Canada but 53 countries immediately banned imports of U.S. beef and beef products. Coffey et al. (2005) estimated that the associated costs to the beef industry due to BSE for the year 2004 alone were $200 million. There was also a significant decrease in sales volume and price (Coffey et al. 2005). Total beef exports from 1990 to 2013 are presented in Figure 1. These data are annual value of fresh, chilled or frozen beef and veal products (Figures 1, 2 and 3) obtained from the USDA Foreign Agricultural Service Global Agricultural Trade System (GATS 2014). Beef exports totaled $3 billion in 2003. BSE export bans caused total beef exports to decline 83% in value from 2003 to 2004. Since 2004, the United States has been repairing the beef export market. From 2004 to 2013 U.S. beef exports have grown nearly tenfold, to over $5 billion in 2013, well above pre-BSE levels (72% increase from 2003 to 2013).

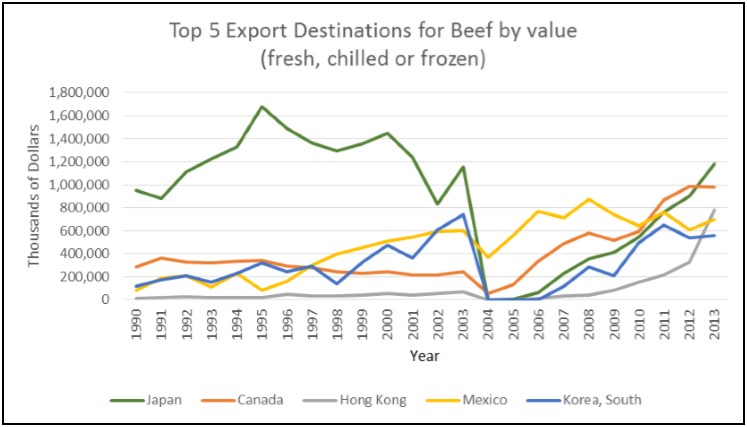

The top five export destinations for U.S. beef products in 2013, Japan, Canada, Hong Kong, Mexico and South Korea, are presented in Figure 2 (GATS 2014). Prior to the U.S. BSE incident, Japan was the top export destination accounting for over 61% of the total exports in 2003. Following the discovery of BSE in the United States, Japanese regulators closed their markets to all imports of U.S. beef. In 2005, Japan began allowing some imports of U.S beef from cattle 20 months of age and younger. After opening trade, exports to Japan rose from about $5 million in 2005 to $903 million in 2012. In February 2013, Japan began allowing imports of U.S. beef from cattle 30 months of age and younger. Consequently, exports to Japan rose over 30% in 2013 making them once again the top export market for U.S. beef. Despite rising retail beef prices due to the limited supply of cattle in the United States as well as changing exchange rates, demand for U.S. beef in Japan has stayed relatively strong. Currently (January through August, 2014), the United States has exported almost $850 million in beef to Japan, slightly above last year's level of $845 million (January to August, 2013).

The most recent trade disruption in beef products is the use of hormones and beta agonists in cattle production. The European Union bans the use of both hormones and beta agonists and maintains trade restrictions on U.S. beef. Russia and China also maintain a zero tolerance policy for the presence of residues of hormones and beta agonists in beef and apply trade restrictions to U.S. beef. U.S. producers that currently export to the European Union have to certify that their products are free of these substances; however, U.S. producers have been unwilling to do the same for Russia.

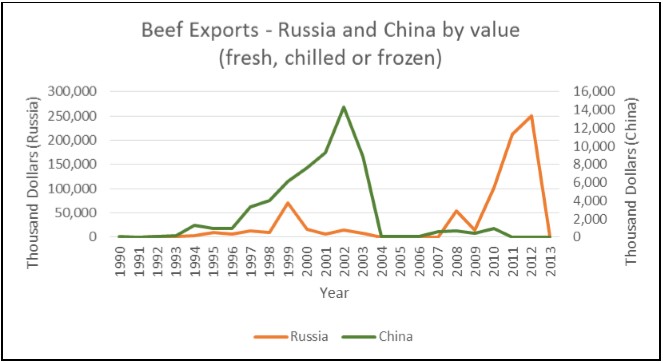

Exports to Russia and China from 1990 to 2013 are presented in Figure 3 (GATS 2014). It is interesting to note the changing pattern of trade with these two countries. Figure 3 shows the impact of the BSE trade ban in 2004 and how around the same time the beta agonists restrictions started to affect trade. In the case of Russia, we observe how the consequences of the 1992 economic reforms after the dissolution of the Soviet Union (removal of some subsidies and fall in income) set the stage for an increase in beef products imports from the United States (Osborne and Trueblood 2002). However, the trend did not last long and exports started to decrease in 2000, from $70 million in the peak year 1999 to $8.6 million in 2003. Trade in beef products resumed in 2008 to reach a new peak in 2012 of $250 million only to stop the following year, 2013, after Russia prohibited imports of all U.S. beef, pork, turkey and other meat products because of the use of beta agonists in cattle production (USDA 2013). In the case of China, we observe how as income rises, demand for U.S. beef products slowly increases in the early-1990s and rapidly increases in the late-1990s, peaking in 2002 with $14 million in beef products (right after China's accession to the World Trade Organization (WTO)). However, U.S. beef exports to China have remained very low since 2004 (under $1 million and in most years closer to zero) because of the BSE incident and concerns over the use of hormones and beta agonists in cattle production.

Trade restrictions have caused major disruptions to the U.S. beef industry over the years. U.S. beef exports have rebounded beyond pre-BSE levels, and consequently, future trade disruptions could have a larger impact on the U.S. cattle industry than previously seen. Disease issues and controversial production practices have the potential to abruptly disrupt trade for an indefinite time. However, there is a fundamental difference between BSE and the use of hormones and beta agonists in cattle production. While BSE in cattle has been scientifically linked to the fatal human variant Creutzfeld-Jacob Disease, there has been no accepted scientific proof of damage caused to humans by the use of hormones or beta agonists in cattle production. The European Union and other countries often apply the precautionary principle to food safety issues. According to the WTO, the precautionary principle allows countries to implement "protective action before there is a complete scientific proof of a risk" (WTO 2014). Understanding how different restrictions impact U.S. beef trade is important.

Kate Brooks

Livestock Marketing Specialist

UNL Ag Economics Department

kbrooks4@unl.edu

402-472-1749

Lia Nogueira

Assistant Professor

UNL Ag Economics Department

lia.nogueira@unl.edu

402-472-4387

Jacob Birch

Graduate Assistant

UNL Ag Economics Department

References

Coffey, B., J. Minert, S. Fox, T. Schroeder, and L. Valentin. 2005 "The Economic Impact of BSE on the U.S. Beef Industry: Product Value Losses, Regulatory Costs, and Consumer Reactions." Livestock Economics, MF-2679, Kansas State University Agricultural Experiment Station and Cooperative Extension Service. May 2005.

GATS. 2014. USDA Foreign Agricultural Service Global Agricultural Trade System. Accessed September 2014. http://apps.fas.usda.gov/gats/

Osborne, S. and M. Trueblood. 2002. "Agricultural Productivity and Efficiency in Russia and Ukraine: Building on a Decade of Reform." Agricultural Economic Report No. 813.

USDA. 2013. Statement by U.S. Agriculture Secretary Tom Vilsack and U.S. Trade Representative Ron Kirk on Russia's Suspension of U.S. Meat Exports, February 11, 2013. Accessed October 2014. http://www.usda.gov/wps/portal/usda/usdahome?contentid=2013/02/0023.xml

WTO. 2014. "The Precautionary Principle." Accessed October 2014. http://www.wto.org/english/tratop_e/sps_e/sps_agreement_cbt_e/c8s2p1_e.htm