Cornhusker Economics Sept. 8, 2021

EU and US Consumers’ Willingness to Pay for Genome-edited Apples

By John C. Beghin, UNL

New Plant Engineering Techniques (NPETs) refers to new biotechnology tools that allow alterations to a plant’s genome by adding, resequencing, or silencing some of its genes or combined with genes from a crossable plant (so-called cisgenesis). NPETs include genome editing (GenEd) tools, such as Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR), and transcription activator-like effector nucleases (TALEN). These techniques lead to mutations in plants, which could have been obtained with conventional hybridization and genetic mutation techniques. For that reason, they may be perceived as more natural. These techniques might raise fewer concerns than transgenic techniques incorporating foreign genes into a plant leading to genetically modified organisms (GMOs). GMOs are as safe as conventional plant substitutes. Nevertheless, consumers in most countries have discounted if not rejected GMOs, especially in Europe. It is important to gauge the social acceptability of these NPETs and their market potential.

This Cornhusker Economics article reports on a project recently published in the journal Appetite (Marette et al., 2021) and measuring consumers’ attitudes towards and willingness to pay (WTP) for GenEd apples in Europe and the US. These apples are not available commercially in Europe or the US, although the project was inspired by the newly developed Arctic © apples based on NPETs. The project used hypothetical choices in experimental labs and different technology messages, to estimate WTP of 162 French (as illustrative of Europe) and 166 US Midwest consumers for new apples. These apples do not bruise as easily as conventional apples and do not brown upon being sliced or cut. Messages to consumers in the experiments centered on the social and private benefits of having these new improved apples and on possible technologies leading to these new benefits (alternatively, no technology information, conventional hybrids, GenEd, and GMO). A socio-demographic exit questionnaire was also conducted to gauge consumers’ attitudes.Results show that on average, French consumers do not value the innovation and heavily discount it when it is created via biotechnology. On the other side of the Atlantic, US consumers do value the innovation on average, as long as it is not generated by biotechnology (either GMO or GenEd). In both countries, the steepest discount is for GMO apples, followed by GenEd apples. The average valuations obfuscate the strong heterogeneity in valuation and attitudes among consumers in both countries. The discounting occurs through “boycott” or “protest” by consumers with a pronounced dislike of biotechnology with zero or near zero valuation of the biotech apples. The proportion of protest consumers with zero WTP for the GenEd apples was 42.6% in France and 19.3% in the US. The discounting is weaker for US consumers compared to French consumers.

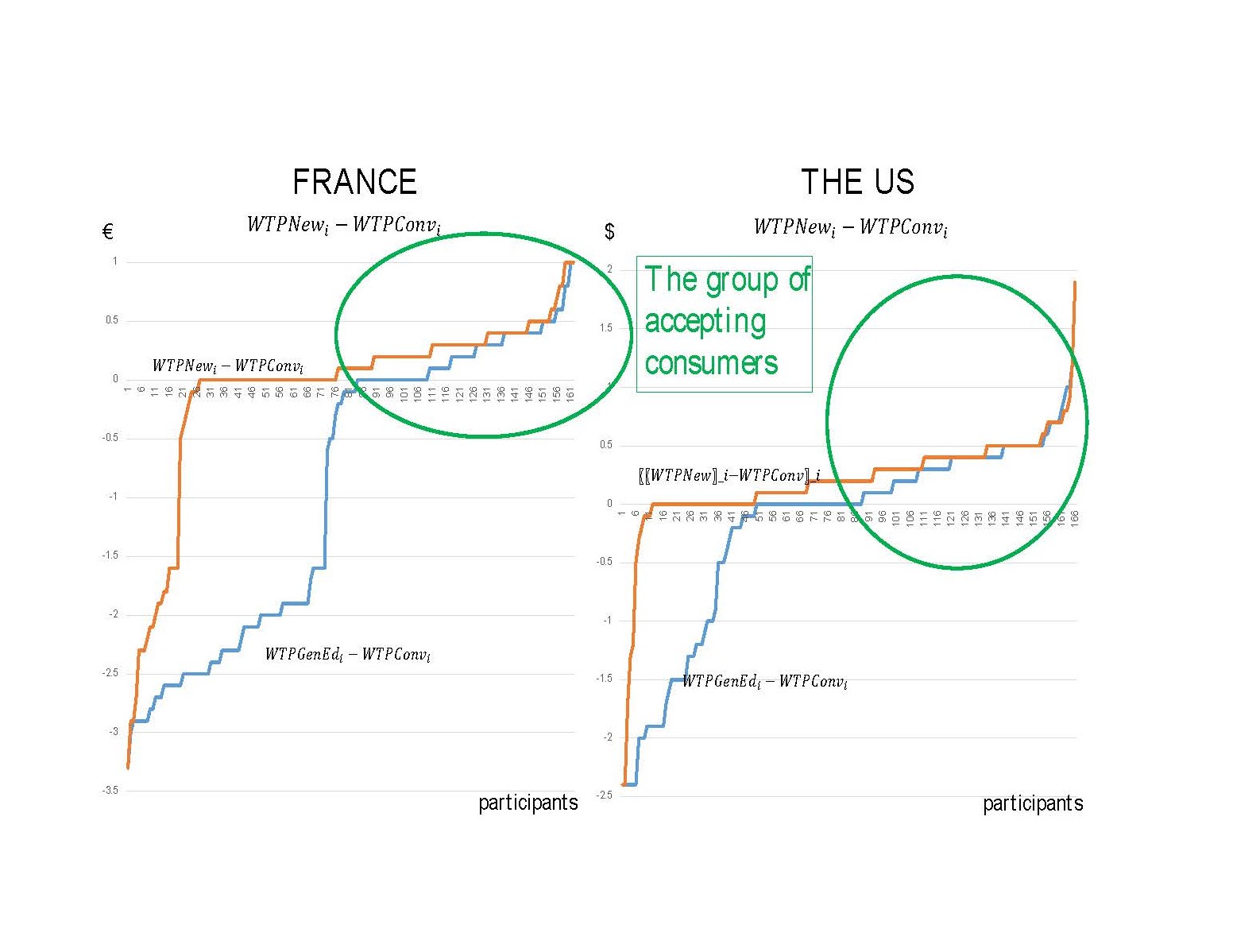

In both countries, a subgroup of consumers actually put a high value on the improvement. Based on a set of questions in the questionnaire on attitudes towards sciences and innovations in food, the researchers developed an index measuring attitudes towards sciences and new technology. Favorable attitudes offset the discounting of GenEd apples in both countries in econometric estimations reported in Marette et al. Figure 1 shows the premium (WTP for new apple-WTP for conventional apple), ranked in increasing order, for both samples. The orange curve shows the valuation premium/discount when only the information on the improvements is provided. The blue curve shows the same premium/discount when the message also provides information on the GenEd technology used to produce the new apple.

GenEd technology is strongly disliked by many consumers in both countries. The difference in valuations is below zero, indicating the discount for the improved apple. The area between the two curves captures the potential cost of regret if consumers bought the new apples but learned ex-post that the improved apples were created using GenEd technology, which many dislike. The cost of regret is significant and shows the importance of informing consumers about the technology underlying the innovation. How to deliver this information is not straightforward because consumers often do not read labels in real retail shopping environments. They also tend to saturate their attention as more information is provided. The marginal impact of additional information decreases quickly, even in experiments. The green circles indicate the two subsets of consumers willing to pay a premium for the improved apple when produced with GenEd technology. For these consumers, the GenEd technology is very slightly discounted (the blue curve stays below the orange curve for most observations). A similar curve and discussion of regret could be done for the GMO technology. Finally, the cost of regret is negligible for the hybrid technology as consumers in both countries view hybrid as natural. The lack of information does not induce regrets later on. These additional cases are not shown to keep the figure manageable.

Figure 1. WTP differential for new and conventional apples with (blue) and without (orange) technology information in France and the US. Note the zero line crossing the vertical axis is at a different heights for France and the US. The positive scale is also larger for the US figure than for the French one.

In sum, the figure and the study suggest that a market could emerge for these GenEd apples, provided that the innovation and regulatory approval remain cost-effective. The advantage of GenEd and other NPETs is that their cost is lower than transgenic techniques. In addition, the R&D process and innovation potentially take less time than traditional hybrid breeding methods. Developing a new apple variety takes 20 to 25 years using conventional hybrids. NPETS could shorten this period and increase the odds of developing desirable characteristics relative to traditional hybrids. International trade, if not impeded by heterogeneous regulations, could help to provide scale to these markets and spread the cost of innovation over more units.

For further reading

On the project:

Marette, Stéphan, Anne-Célia Disdier, and John C. Beghin. "A comparison of EU and US consumers’ willingness to pay for gene-edited food: Evidence from apples." Appetite 159 (2021): 105064.

Marette, Stephan, John Beghin, Anne-Célia Disdier, and Eliza Mojduszka. Can foods produced with new plant engineering techniques succeed in the marketplace? A case study of apples. No. 1723-2021-830. 2021. https://ageconsearch.umn.edu/record/309701/

Marette, Stephan, Anne-Célia Disdier, Anastasia Bodnar, and John Beghin. “New Plant Engineering Techniques, R&D Investment, and International Trade.” 2021. (Available from the author).

On valuation of and attitudes towards novel food created with NPETs:

Beghin, John C., and Christopher R. Gustafson. "Consumer valuation of and attitudes towards novel foods produced with NPETs: A review." (2021). https://ageconsearch.umn.edu/record/313220/

John C. Beghin

Department of Agricultural Economics and

Yeutter Institute of International Trade and Finance

University of Nebraska-Lincoln

beghin@unl.edu

402-472-2749