Cornhusker Economics Sept. 22, 2021

Farm Program Projections and Management Implications

By Brad Lubben, UNL

USDA’s Farm Service Agency annually distributes commodity program payments to enrolled crop producers every October. The payments come either as Agricultural Risk Coverage (ARC) payments or Price Loss Coverage (PLC) payments With higher commodity prices since last fall, the expectations for payments and the reliance on payments as part of the farm’s bottom line are substantially reduced. However, there are still some payments to be made and some important lessons from the current outlook for prices and farm program support.

Program Payment Calendar

ARC and PLC program payments made each October actually reflect the previous calendar year’s crop. The programs are a function of the national marketing year average price received by producers and cannot be calculated until the marketing year is complete. Because the crop marketing year begins with harvest and runs for twelve months, the crop marketing year is never complete until the next crop is about to be harvested. Considering a few major crops in Nebraska, the marketing year is September-August for corn, sorghum, and soybeans and is June-May for wheat. For further detail, the national marketing year average price is a weighted price determined from price and quantity data collected by USDA’s National Agricultural Statistics Service (NASS). At the end of each month, NASS reports an estimated price for the month based on mid-month observations and publishes a weighted average price for the previous month based on the full calculation of prices and quantities. This includes quantities marketed during the month where the price was set in a prior period through a forward contract or other marketing agreement and not just quantities sold at posted prices during the period. Because the official price estimate for the month is calculated and published at the end of the following month, the August prices that are the final part of the marketing year for several crops are not published until the end of September and thus farm program payments are not calculated and distributed until October. As an aside, the final marketing year average price for wheat and other crops with an earlier marketing year is known earlier, but payments are still not made until October.

2020 Crop Program Payments

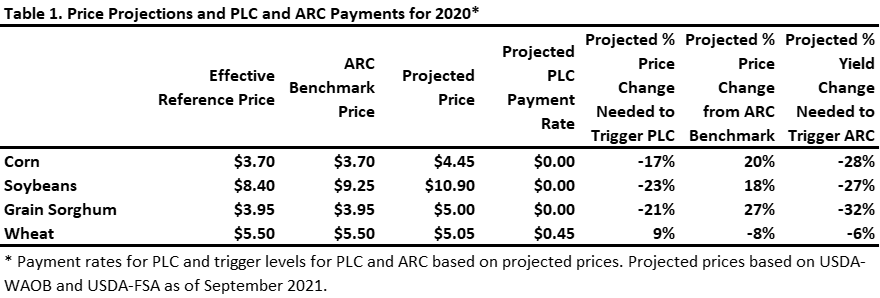

The ARC and PLC payments coming in October 2021 are based on marketing year prices and yields for the 2020 crops. The PLC program is a straightforward calculation of the effective reference price minus the national marketing year average price, if the market price falls below the reference price. While the wheat price is final at $5.05/bushel and will result in a PLC payment rate of $0.45/bushel, the other major commodities will not see a PLC payment based on current price projections (see Table 1). In fact, prices would have to drop more than 15% before a PLC payment would trigger. This is simply not possible with just the final month of the marketing year yet to be published.

For ARC, the payment outlook is more complicated. ARC at the county level (ARC-CO) pays if actual revenue falls below a guarantee tied to 86% of the national benchmark price multiplied by the county benchmark yield on a crop-by-crop basis, calculated separately for irrigated and nonirrigated practices in most counties. ARC at the individual farm level (ARC-IC) pays if revenue falls below a guarantee tied to the national benchmark price and the farm benchmark yield by crop adjusted for the farm’s current year crop mix.

While actual ARC payments are a function of both price and yield, analyzing only price projections can still give substantial insight into potential ARC payments. Given the projected price change relative to the ARC benchmark, the final column in Table 1 indicates how far yields would have to drop to trigger an ARC payment for each of the major Nebraska commodities. With wheat prices 8% below the benchmark, yields would need to drop 6% below the benchmark to result in a 14% revenue drop that would trigger an ARC payment. For other commodities with higher prices, the yield loss would need to be near 30% or more before ARC would be triggered. The likelihood of this happening at the county level for any commodity other than wheat is remote. Thus, the projection of any ARC-CO payments for 2020 in Nebraska is minimal. The yield losses to trigger ARC could more likely happen at the individual farm level for those enrolled in ARC-IC. However, the revenue is combined across crops before compared to the farm revenue guarantee. Therefore, yield losses would need to be substantial across crops for any ARC-IC payments to occur.

Considering the available price projections and enrolled acreage, total ARC and PLC payments in Nebraska paid in October 2021 for the 2020 crop year could be less than $30 million, as compared to the nearly $400 million average over the 2014-2019 period.

2021 Crop Program Payments

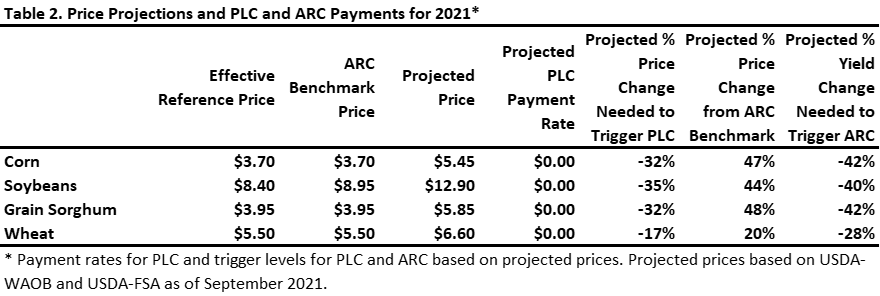

For the 2021 crop year to be paid in October 2022, current projected prices are substantially above both the effective reference price used for PLC and the benchmark price used for the ARC guarantee, and the likelihood of any ARC or PLC payments is minimal. As shown in Table 2, prices would need to drop from current projections by 17% to trigger a wheat PLC payment and by more than 30% to trigger a PLC payment for other major commodities. For ARC, the drop to trigger any payments would be even greater, necessitating a 28% drop in wheat yields or more than 40% drop in yields for other major commodities. Except for severe losses in some drought counties or on individual farms, those levels of yield losses are not likely to occur. Thus resulting in no ARC or PLC payments for 2021 for most producers unless there are substantial changes in prices yet to be realized for the marketing year ahead.

Management Implications

The analysis of projected 2020 and 2021 crop program payments coming from the ARC and PLC programs points to a substantial decline in commodity program payments for producers in 2021 and 2022. This is not an unexpected result nor an unwanted outcome as it is a function of rising commodity prices over the past year. More crop revenue coming from the market and less from the federal commodity program is a preferable situation. However, there are a few management implications worth noting.

First, and perhaps most significant, is that the farm program safety net is providing less safety from price risk. Prices or revenue would have to drop substantially before ARC or PLC would kick in for 2021 crops, meaning producers are shouldering more of the risk of any drop from currently projected price levels and average yields before the farm program would begin to help. That puts a bigger premium on sound producer risk management decisions.

Second, higher crop price prospects may have encouraged more production in 2021 and may also contribute to higher input prices in the year and years ahead. Higher prices and higher costs can still stress management decisions and profitability margins even as farm safety net programs become less relevant. Farm program supports could adjust up marginally under existing formulas for sustained higher prices, but they won’t adjust up for higher input costs (except for the Dairy Margin Coverage program, a topic for a different discussion).

Finally, while today’s higher commodity prices have strengthened bottom lines and balance sheets, most long-run projections find little evidence to support sustained higher price levels and tend to fall back toward previous price levels. For example, recent corn price projections from the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri point to corn prices falling from current levels back toward $4.55 for the 2022 crop and to $4.18 for the 2026 crop. These prices would be far above the mid-$3 level of the entire 2014-2019 period but would be a sharp pullback from the $5-plus level at present. Keeping longer-run price projections in mind as crop mix and investment decisions are being made is also an important part of sound management decision-making.

Brad Lubben

Extension Associate Professor

Department of Agricultural Economics

University of Nebraska Lincoln

blubben2@unl.edu

402-472-2235