Content

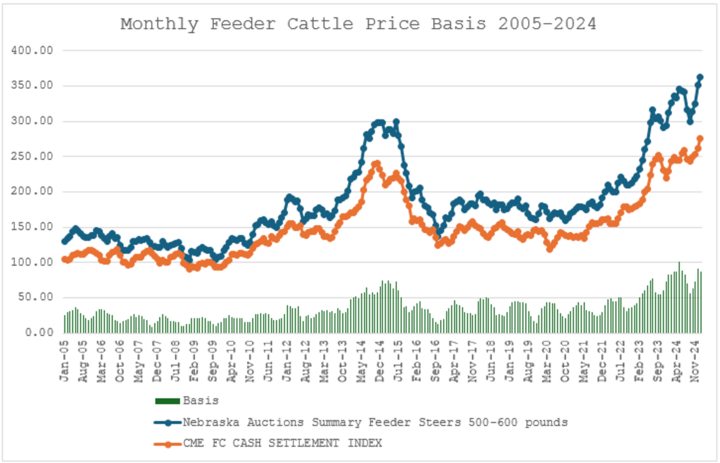

The prices for all classes of cattle have been historically quite strong since 2023. Current prices have many cow-calf and stocker-yearling producers looking for opportunities to either lock in a price or to protect a floor price. It is important to understand what price protection each risk management tool provides and the residual price risk exposure. Since 2023, feeder cattle price basis in Nebraska has been historically high (Chart 1) and, therefore, the risk associated with it should be a significant area of concern for producers. Most risk management tools do not address basis risk and it is important for producers to realize what that means in terms of strategies that protect their bottom line.

What is basis?

When utilizing price risk management tools for calves and feeder cattle, it is important to recognize the basis risk associated with using these devices. Dr. Andrew Griffith from the University of Tennessee defines basis as “the difference between the cash price and the futures price for the time, place, and quality where delivery actually occurs.” In simple terms, basis is the difference between two numbers. It is important to define what those two numbers are and be consistent in making that comparison. For calves and feeder cattle marketing, basis is usually defined as the difference in the actual price received for a specified class of cattle at a time and place in relation to the CME futures prices for feeder cattle at that same point in time. The University of Tennessee Extension Circular titled “Understanding and Using Cattle Basis in Managing Price Risk” is an excellent resource for understanding what basis is and the factors that influence it.

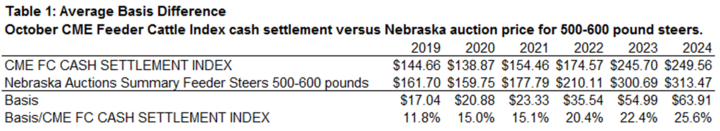

As an example, if calves are to be marketed in October, the basis a cow-calf producer should be concerned with is the difference between the CME feeder cattle contract price for October and the cash price they will receive when they market the calves. Table 1 shows the comparison between the CME Feeder Cattle Contract Settlement Index for October from 2019-2024 compared to the average Nebraska auction market price for 500-600 pound steers. On average, this difference was $36 over the 6-year period. However, it ranged from $17 in 2019 to $64 in 2024. Most price risk management tools for feeder cattle, such as futures contracts, put options, and Livestock Risk Protection (LRP) insurance only manage the risk associated with the CME futures contract prices, leaving the producer exposed to basis risk.

What is basis volatility risk?

In 2022, researchers at Kansas State University published a paper titled “Feeder Basis Risk and Determinants.” In that paper, researchers reviewed historic feeder cattle basis risk and noted that basis variation has increased gradually since 1997 and then “elevated sharply” in 2014 and 2015 before returning to a less variable period from 2016 through 2021. The current market conditions are not unlike those experienced in 2014 and 2015 when cattle supplies were tight. In Nebraska, this translates into a positive price basis for 500–600-pound steers that is more than double what it was a few years ago.

Chart 1 shows a historical comparison over a 20-year span from January 2005 to December 2024 between the monthly average CME Feeder Cattle Contract Settlement Index and the monthly average Nebraska auction market price for 500-600 pound steers. The difference between the two, or basis, is charted along the bottom in green bars. This chart shows visual evidence of the variation in basis described in the preceding paragraph. From 2005 through 2013, the basis averaged around $23 or just under 20% of the CME Feeder Cattle Contract. From 2014-2015, it jumped to an average of $56 or 27% of the CME Feeder Cattle Contract only to revert back to an average of $34 or 23% for the period from 2016-2022. Over the last two years, from January 2023 through December 2024, the basis was an average of almost $71 and over 30% of the CME Feeder Cattle Contract. This may lead to circumstances where downside basis risk is much higher in the near term than it has been historically. This means the actual cash price a producer receives for a given set of cattle, even though they use a price risk management tool, may be significantly lower than expected because of basis volatility. Cow-calf producers and stocker-yearling operators looking to utilize price risk management tools should take these conditions into account as they think about marketing cattle and the price they expect to receive.

How does a producer deal with basis volatility risk?

The only tool available to remove basis risk for calves and feeder cattle is the utilization of a forward cash contract where cattle are sold to a specific buyer for an agreed upon weight and price to be delivered at a determined future time and place. This method of marketing eliminates the opportunity for the seller to participate in market price appreciation should that occur. Understanding the historic basis for a class of cattle in comparison to CME Feeder Cattle Futures is helpful in estimating the expected ending value for those cattle when using price risk management tools. Historic records of basis for classes of cattle and tools such as beefbasis.com, can be used to understand what the “expected” basis would be for a specific set of cattle delivered to an auction market on a determined future date relative to the nearby CME Feeder Cattle futures price. This basis information can also be used in negotiating a contractual agreement for the future delivery of a specific class of cattle.

Seven things to remember about basis and price risk management tools.

- Price risk management tools based on futures markets can reduce market price risk for cow-calf and stocker-yearling producers.

- Basis risk needs to be considered when using price risk management tools.

- Price risk management tools such as Livestock Risk Protection insurance, put options, and futures contracts do not address basis risk.

- Basis volatility risk tends to be greater for classes of cattle that are more different than the CME Feeder Cattle Futures specifications of a 700 to 899 pound Medium and Large Frame #1 and #1-2 feeder steer traded within the 12-state region identified by the CME.

- Historical basis information is helpful to estimate the expected market price for a given set of cattle but should be evaluated in the context of historic market conditions.

- Basis risk historically tends to be greater when prices are volatile, like they are currently.

- Forward contracting cattle for delivery at a specified weight and price on a given date and location is the only way to remove basis risk.

Understanding basis volatility and the impact it has on the actual price received for calves or feeder cattle in relation to the CME Feeder Cattle Futures is important when considering price risk management opportunities. Currently, cattle markets are in a time frame where volatility appears to be like market conditions experienced in 2014 and 2015. These conditions should prompt producers to think through how basis volatility could impact the expected price they will receive for their calves or feeder cattle.

Chart 1: Nebraska monthly average auction price for 500-600 pound steers from 2005-2024 compared to the monthly average CME Feeder Cattle contract cash settlement index. Basis is provided as the difference between the two with all prices in dollars per hundredweight ($/cwt.).

Jay Parsons, Professor

Director, Center for Agricultural Profitability

Department of Agricultural Economics

University of Nebraska-Lincoln

jparsons4@unl.edu

Aaron Berger

Livestock Extension Educator

University of Nebraska-Lincoln

aberger2@unl.edu