Content

Farmers and ranchers are managing through an interesting and challenging time in agriculture. National projections suggest a near-record farm income for 2025 (USDA-ERS) yet other reports show increasing levels of concern in agriculture as financial conditions weaken (Kreitman) and farmer sentiment weakens (Langemeier and Mintert).

Part of the seeming contradiction in ag conditions can be explained by the economic outlook for crops versus that for livestock. While cattle producers are enjoying record prices at present amid tight supplies and sustained consumer demand, crop producers have generally faced declining prices and tightening margins every year since 2022 (USDA-WAOB). The added livestock revenue and temporary relief from ad hoc government assistance in 2025 both help with profitability and cash flow for now but also come with questions about how long the current situation will last.

For livestock producers, the questions involve making production, marketing, and investment decisions for a cattle cycle that should eventually rebound and increase beef supplies, putting pressure on future prices and returns. For crop producers, the questions include the potential cash flow gap between ad hoc assistance for the moment and farm income safety net increases included in the “One Big Beautiful Bill Act” that promise help for the future but no additional payments until the fall of 2026. The crop outlook also depends on the role of exports and biofuels in the demand picture, both of which are fundamentally impacted by policy issues and uncertainties at present.

To be successful, producers need to effectively manage the risks they face with risk commonly defined as the possibility of loss, often with quantifiable outcomes and probabilities. For example, producers can use marketing strategies or crop insurance tools to reduce or mitigate price risk or production risk and manage measurable risks to the operation.

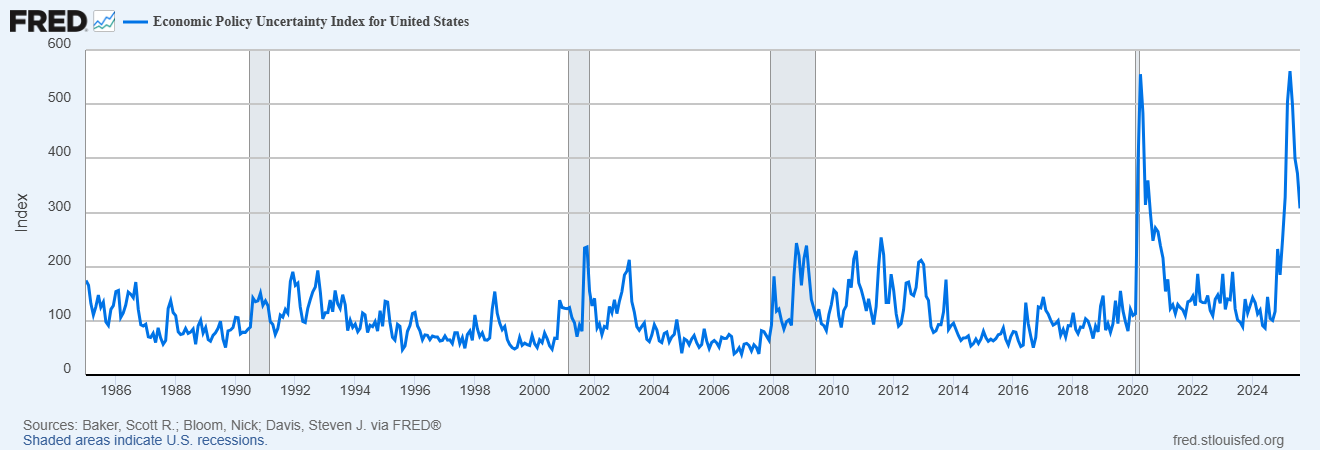

Uncertainty differs from risk and refers to a lack of information from which to even make a decision. While uncertainty fundamentally references what we don’t know, economists have found a way to measure the degree of uncertainty (Baker, Bloom, and Davis). Figure 1 shows an index of U.S. economic policy uncertainty the authors created from tabulations of news coverage of economic and government policy issues and uncertainty as posted on FRED, the Federal Reserve economic data website hosted by the Federal Reserve Bank of St. Louis.

Figure 1 Economic Policy Uncertainty Index for the United States

The uncertainty index reached record levels in early 2025, surpassing even the heights of the COVID pandemic in 2020. Amid mixed economic signals for the U.S. economy, heightened trade conflict, and on-going debates over tax policy, the index peaked in April 2025 before declining to still-high levels as of August. The “One Big Beautiful Bill Act” resolved many tax policy questions, likely helping to bring the index down even as the economic and trade policy outlook remains uncertain.

While the index helps confirm a heightened level of uncertainty and an increased difficulty in making business decisions, farmers and ranchers still need to make decisions to effectively manage risks not only for the moment but for the long run as well.

The North Central Extension Risk Management Education Center exists to support and fund educational projects that help producers make sound risk management decisions and position their operations for success. The risks and the educational efforts encompass a broad spectrum from production and market risk to financial, legal, and human risk. The center invests time and resources in needs assessment each year to help inform and prioritize the funding support. Input from stakeholder listening sessions, surveys, and discussions provides a broad perspective of risks and educational needs for producers and helps inform the current outlook amid such uncertainty.

Needs assessment discussions earlier this year recognized the current economic concerns and outlook. Stakeholders identified marketing and price risk management as a key issue along with informed crop insurance decisions and the need for better integration of the two risk management strategies. Making marketing decisions or crop and livestock insurance decisions without understanding or considering the impact of one on the other can shortchange effective decisions and even create unexpected exposure to new risks.

The discussion also highlighted the need for improved farm recordkeeping and analysis to inform financial management, enterprise analysis, and benchmarking to assess efficiency. Making sound decisions about production systems, cost of production, enterprise mix, or farm and ranch growth depends on solid records and analysis.

As producers consider the current outlook for traditional commodity production and marketing, many are looking for alternative enterprises or opportunities to build revenue. Beyond the need for good records as a foundation for good decisions, the discussion noted the need to analyze new business alternatives, whether it is specialty crops, contract production and marketing opportunities, or ag and energy lease opportunities (such as wind and solar) among others. New enterprises and products that might command higher prices in the market usually also demand a new, higher level of management to address production requirements, market development, regulations, or contract arrangements.

Every area of risk includes issues that need to be addressed on a regular basis, perhaps even daily, while also including issues that fundamentally affect the long-term success and viability of the operation. Labor management was identified as a need and can encompass all the current issues of labor supply, hiring, training, retention, and management as well as family labor and communications issues that come up every day. But the human risk area also includes attention to personal health and well-being and to farm transition, issues that don’t often receive regular attention, but that could be even more critical to the long-run success and viability of the operation.

Asset management was also mentioned as an educational need. The ag economic outlook suggests more financial pressure on land ownership and lease arrangements, but the management need goes beyond just economic analysis or renegotiation of lease terms. Landlord and tenant communications are a critical part of the equation, not just to stay current on the economics of the operation and the lease, but to keep both parties informed, particularly as landowners may become more and more separated from the farm. Part of the land discussion also focused on lease opportunities and land access for producers and enterprises other than traditional large-scale commodity production. Beginning, small-scale, or specialty crop/livestock producers also face land access and management issues and while the needs and the arrangements may be very different, they can be rewarding for both parties.

Beyond the specific educational needs of producers, there was also some attention to educational methods. Extension professionals and many other ag organizations or providers generally know and can master the broad portfolio of educational materials and curricula, decision tools, and educational meetings for producers. However, the needs assessment discussion also highlighted the role of peer-group learning, with producers learning from each other. Some groups and educators are very accomplished in building and supporting peer groups, but their wider use was encouraged, recognizing that producers can often talk and learn more in groups of peers from across a broad region than they can in an educational meeting with all of their neighbors farming and ranching (and competing) in the same geographic area.

The needs assessment process has a primary purpose of informing and prioritizing the center’s annual funding support for producer-focused risk management education projects. However, it also provides a good general overview of the range of risks that producers face on a regular basis and the challenges they have in managing their farm or ranch under the increased risk and uncertainty they face today.

Bradley D. Lubben

Extension Policy Specialist and Director

North Central Extension Risk Management Education Center

Department of Agricultural Economics

University of Nebraska-Lincoln

(402) 472-2235

brad.lubben@unl.edu

References:

Baker, Scott R., Bloom, Nick and Davis, Steven J. 2025. “Economic Policy Uncertainty Index for United States [USEPUINDXD].” Federal Reserve Bank of St. Louis. Retrieved from https://fred.stlouisfed.org/series/USEPUINDXD on September 3, 2025.

Kreitman, Ty. 2025. “Farm Financial Conditions Continue to Deteriorate.” Federal Reserve Bank of Kansas City. Retrieved from https://www.kansascityfed.org/agriculture/ag-credit-survey/farm-financial-conditions-continue-to-deteriorate/ on August 17, 2025.

North Central Extension Risk Management Education Center. 2025. Website available at http://ncerme.org.

Langemeier, M. and J. Mintert. 2025. “Farmer Sentiment Weakens As Producer Confidence In The Future Wanes.” Purdue University. Retrieved from https://ag.purdue.edu/commercialag/ageconomybarometer/farmer-sentiment-weakens-as-producer-confidence-in-the-future-wanes/ on September 8, 2025.

U.S. Department of Agriculture, Economic Research Service. 2025. “Farm Income and Wealth Statistics.” Retrieved from https://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics, September 3, 2025.

U.S. Department of Agriculture, World Agricultural Outlook Board. 2025. “World Agricultural Supply and Demand Estimates.” Retrieved from https://www.usda.gov/about-usda/general-information/staff-offices/office-chief-economist/commodity-markets/wasde-report on August 12, 2025.