Content

By Christine Lockert, Sheila Aikanathan Johnson and Brad D. Lubben

Farmers and ranchers face many risks and challenges in production agriculture every day. Changing market fundamentals, farm policy reforms, and crop insurance program developments defined the risk environment that led to the authorization of agricultural risk management education as part of the Agricultural Risk Protection Act of 2000. The educational efforts that have followed have been designed to help producers manage the full range of production, marketing, financial, legal, and human risks that are all part of agriculture.

In the more than two decades since, the risks facing producers have continued to grow. Producers have managed through the bioenergy and agricultural commodity boom cycle, the economic challenges of the Great Recession, and the supply chain and market shocks of the COVID-19 pandemic. They have also coped with droughts, floods, and other storms over time and now face disruption from trade and policy uncertainty that add to the wide range of shocks producers have had to manage.

The farm sector remains in a solid financial position, although producers have had to deal with tightening margins for most commodities over the past few years. Managing those financial challenges amid all of the other risks and uncertainty in agriculture will continue to be a major challenge for farmers and ranchers. Educating producers to manage risk and position their farm or ranch for future growth and success is the fundamental purpose of the Extension Risk Management Education (ERME) program.

The ERME program, funded by USDA’s National Institute of Food and Agriculture, provides training to help producers learn new strategies to manage complex and growing agricultural risks. ERME strives to achieve this goal by encouraging and funding innovative programs across the country and helping programs focus on tangible results. Four regional grant-making ERME Centers are located across the country at the University of Delaware (Northeast), the University of Arkansas (South), Washington State University (West) and the University of Nebraska-Lincoln (North Central) along with a Digital Center at the University of Minnesota to help administer online application, management, and reporting elements of the program.

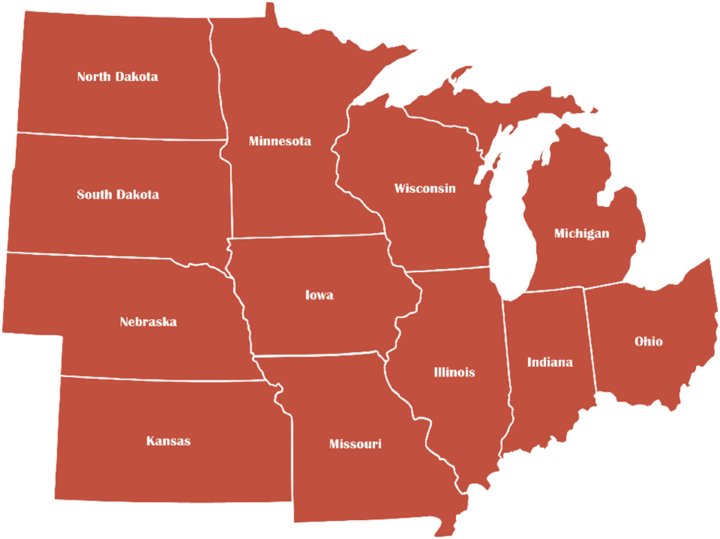

Established in 2001 and located at the University of Nebraska-Lincoln Agricultural Economics Department, the North Central Extension Risk Management Education Center (NCERMEC) has a long history of supporting risk management education programs serving producers in the region. The 12-state north central region includes Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, and Wisconsin (Figure 1). Over the last 24 years, the Center has reached more than 175,500 farm and ranch participants and awarded more than $20 million across 545 grants to public, private, and non-profit entities to carry out producer-focused, outcomes-based risk management education programs through its annual RFA.

Figure 1. States served by the North Central ERME region.

What is Risk Management?

Risk management involves taking a deliberate and knowledgeable approach to dealing with one or more of the primary sources of agricultural risk. Figure 2 shows the five general types of risk: production risk; marketing risk; financial risk; legal risk; and human risk (Crane et al. 2013). Managing risks requires resilience, adaptability, and access to resources. By staying informed, implementing sound risk management strategies, and leveraging technology and resources, farmers and ranchers can better mitigate these challenges, enhance profitability, and ensure the long-term viability of their operations.

What are the risks?

Figure 2. There are five general types of risk facing agricultural producers.

Production risk refers to the uncertainty of the management of crops and livestock. Weather, disease, pests, and other factors affect the quantity and quality of the commodities produced.

Marketing risk is the uncertainty about the prices producers receive for commodities sold and what their production costs may be.

Financial risk refers to a producer’s farm credit and the obligation and ability of the farm to repay its debt. The current economic uncertainty greatly affects a producer’s financial risk.

Legal risk results from changing governmental policies. Tax laws, chemical regulations, and changes in the Farm Bill all affect the legal risk a producer faces.

Human risk includes factors such as farm transition/succession, labor relations, disability, intergenerational issues, or divorce.

Competitive Grant Program

NCERMEC, in conjunction with three other regional centers, conducts an annual competitive process to fund outcomes-based risk management education projects designed to empower producers with the knowledge and tools necessary to navigate the uncertainties inherent in agricultural operations. The Request for Applications (RFA) opens each year in September and closes in November.

NCERMEC funding decisions are made by an Advisory Council composed of individuals involved in agricultural lending, insurance, marketing, extension, production, and ag organizations, all from the North Central Region. Successful projects will identify targeted outcomes that will help producers manage risk and then describe how the project will measure those outcomes. These outcomes are the changes in understanding and behavior that will enable participating producers to enhance the viability and profitability of their operations.

Table 1. North Central Region States and Funded Projects

| State | # of Awards 2001-2025 |

| Illinois | 31 |

| Indiana | 30 |

| Iowa | 72 |

| Kansas | 37 |

| Michigan | 29 |

| Minnesota | 68 |

| Missouri | 41 |

| Nebraska | 81 |

| North Dakota | 19 |

| Ohio | 30 |

| South Dakota | 39 |

| Wisconsin | 63 |

| All Other States* | 5 |

| Total | 545 |

| Public Institutions | 425 |

| Private/Non-Profit Institutions | 120 |

| *Serving North Central Producers |

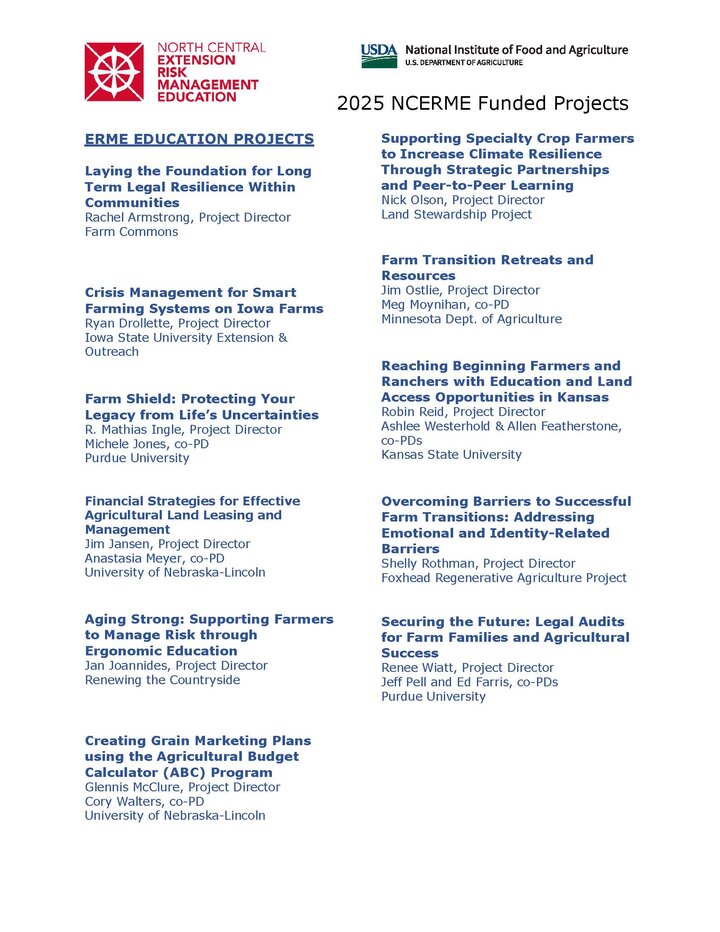

The Center announced the 2025 RFA last fall which included three program areas to apply to: 1) Education Projects focused on a broad range of risk management education topics and activities; 2) Producers Underserved by Crop Insurance Projects specifically designated to deliver risk management education for producers underserved by Federal crop insurance; and 3) Exploratory Projects provided an opportunity to initiate ideas and/or emerging risk topic areas in a smaller planning/development or pilot project. Forty-six applications requesting more than $2.9 million in funding were submitted to the North Central Center through the on-line application process. The Advisory Council recommended 11 education projects, 5 exploratory projects, and 6 projects serving producers underserved by crop insurance for funding. The period of performance is April 1, 2025, through September 30, 2026. The 22 awarded projects represent approximately $1.38 million in total funding.

2025 Funded Projects

Congratulations to the following project directors whose risk management education projects were selected for funding in 2025:

References:

Crane, Laurence; Gantz, Gene; Isaacs, Steve; Jose, Doug; Sharp, Rod. 2013. Introduction to Risk Management – Understanding Agricultural Risk: Production, Marketing, Financial, Legal, Human. Extension Risk Management Education and Risk Management Agency, USDA. Available at: https://cms.unl.edu/ianr/casnr/agricultural-economics/ncerme/sites/unl.edu.ianr.casnr.agricultural-economics.ncerme/files/media/file/IntroductionToRiskManagement.pdf.