Workshop Details

December 2-3, 2025

Nebraska Innovation Campus

2021 Transformation Drive

Lincoln, NE 68508

Early Bird discount before Nov. 18!

- $240 for farmers and ranchers. 20% off ($192) if registered before Nov. 18.

- $440 for for all others. 20% off ($352) if registered before Nov. 18.

- Book your room at the Scarlet Hotel (across the street from the workshop site) with the workshop group rate here.

Captive insurance for agriculture will be explored during a workshop Dec. 2-3, 2025, in Lincoln, Nebraska, where producers, agribusiness, and policy leaders meet to rethink insurance. It will be presented by the University of Nebraska-Lincoln's Department of Agricultural Economics.

Captive insurance is generating plenty of buzz, but also confusion. This conference, "Strategic Risk Financing in Agriculture: The Case for Captive Insurance," will cut through the noise with clear, research-based insights on how it works, what it covers, and whether it can fit into a farm’s risk management plan.

Questions?

Contact Cory Walters, Associate Professor, at cwalters7@unl.edu or 402-472-0366.

Agenda at a Glance

Full Agenda About the Speakers

Day One – December 2, 2025

Noon Registration

12:45 p.m. Welcome & Workshop Objectives

1:00 p.m. Session 1: Current Insurance Market Trends, Issues, and Concerns

2:00 p.m. Session 2 KEYNOTE: Alternative Insurance Capital Management Opportunities

2:45 p.m. Break

3:00 p.m. Session 3: History and Scope of the Captive Insurance Market

3:45 p.m. Session 4: Captive Insurance Solutions for Agriculture

4:15 p.m.: Break

4:30 p.m. Session 5: Using Captives in Agriculture

5:45 p.m. Networking Reception

Day Two – December 3, 2025

7:30 a.m. Networking Breakfast

8:15 a.m. Session 6: Captive Management Concepts (Including Tax and Audit Considerations)

9:15 a.m. Session 7: Ten Questions to Ask a Captive Manager/Administrator

10 a.m. Break

10:15 a.m. Session 8: Long-Run Captive Wealth Strategy – A Historical Perspective

10:45 a.m. Session 9: Strategic Uses of Captives in Agriculture – Where Do We Go From Here?

11:30 a.m. Session 10: Closing Session – Key Takeaways & Action Steps

Agenda subject to change.

Book your group-rate room at the Scarlet Hotel, just across the street from the workshop venue, here.

Speaker Handouts

- Key Benefits of Captive Insurance - William P. White, Owner and Managing Principal, Acuity Strategic Consulting, LLC.

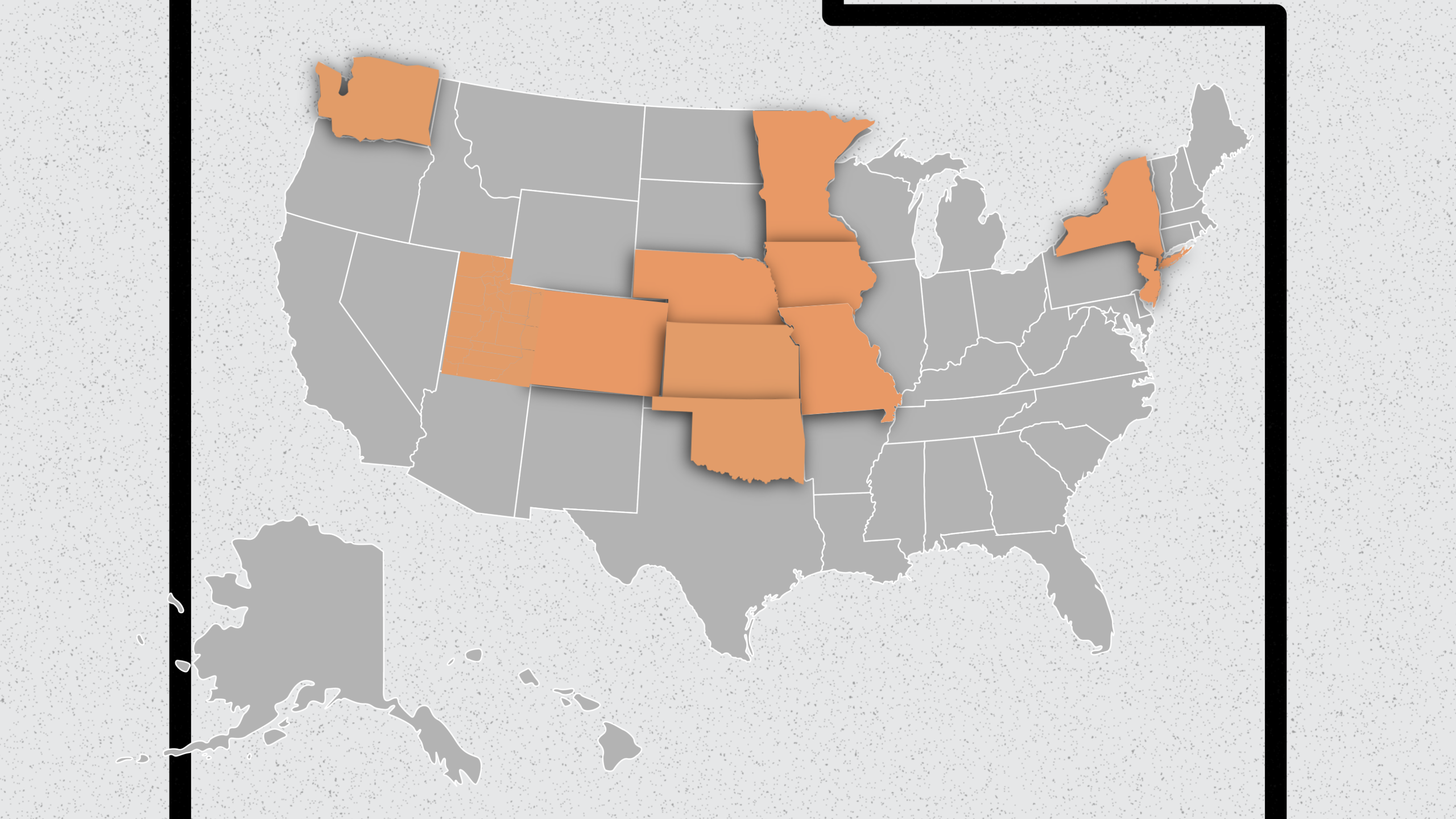

A NATIONAL WORKSHOP

Speakers from Across the U.S.

The event will feature speakers from across the country, including leading experts in captive insurance, agricultural risk management, and financial strategy. Their national perspective will help participants understand how these structures are used in a variety of industries and how similar approaches can be applied to agriculture.

Who's Attending?

Agricultural producers, agribusiness leaders, insurance service providers, policymakers, and anyone else interested in learning about managing agricultural risk through insurance captives are invited to attend!

So far, we have attendees from 11 states registered:

About Captive Insurance

What is captive insurance?

According to the National Association of Insurance Commissioners, a captive, in its simplest form, is a wholly owned subsidary created to provide insurance to its non-insurance parent company (or companies). Captives are essentially a form of self-insurance whereby the insurer is owned wholly by the insured. They are typically established to meet the unique risk-management needs of the owners or members.

Captive insurance and agriculture

Farmers and ranchers using captive insurance can potentially allow for flexibility not available in the traditional insurance market.

Three possible benefits of captive insurance

- Cost savings

- More flexibility in financial planning

- Improved control over risk management

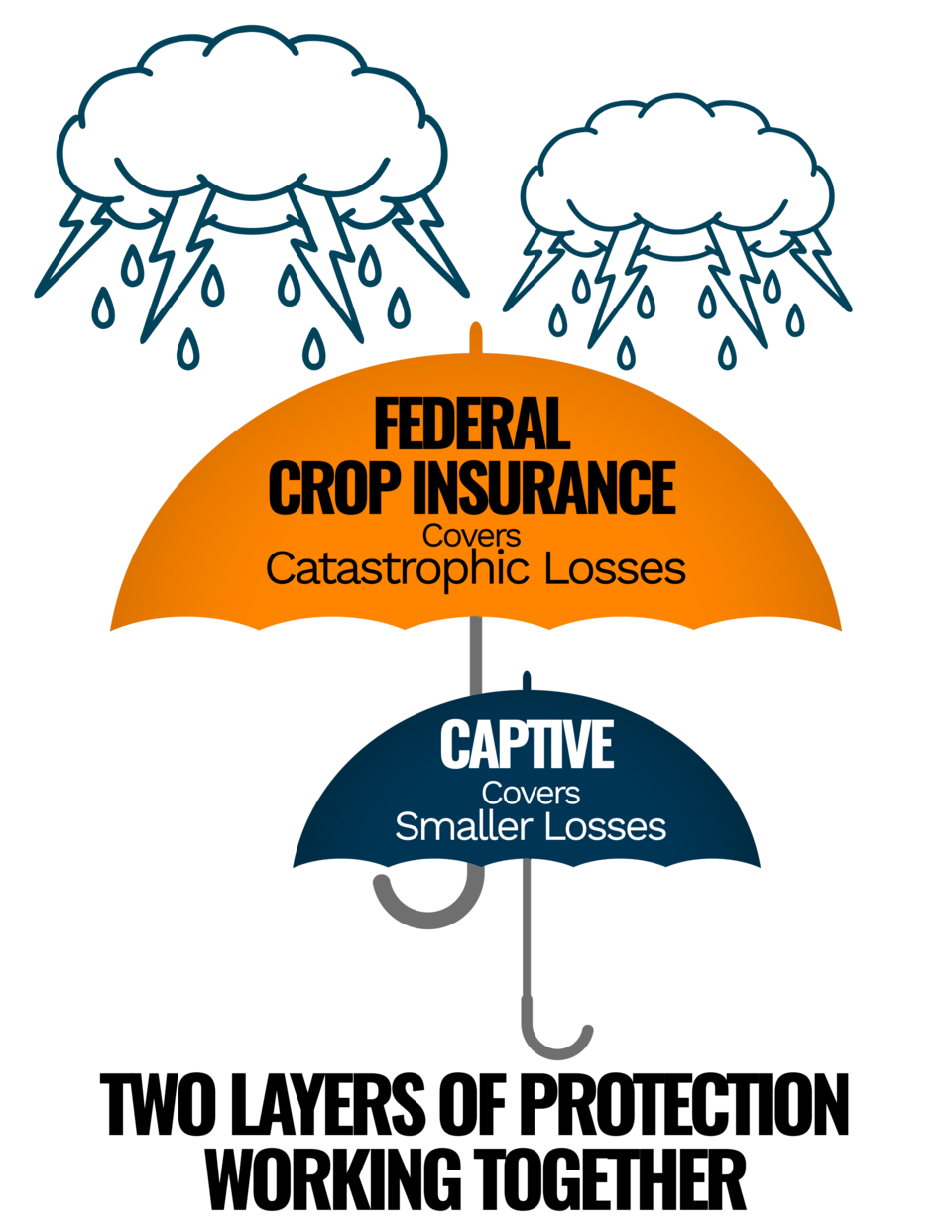

Captives and Federal Crop Insurance Compared

| Federal Crop Insurance (FCIP) | Captive Insurance (Private) | |

| Who provides it? | Federal government, delivered by private agents | Formed/owned by farmers or farm groups |

| What it covers best | Large, catastrophic losses (e.g., widespread drought) | Smaller, deductible-level losses (frequent but less severe) |

| Flexibility | Standardized policies, limited customization | Can be tailored to specific farm risks |

| Premiums | Subsidized but rising; set by FCIP rules | Paid into the farmer’s own captive; retained if unused |

| Claims experience | Sometimes mismatched with actual farm losses (county-based triggers, etc.) | Directly tied to the farm’s actual experience |

| Capital requirements | No special capital needed to participate | Requires scale and upfront capital to establish |

| Farmer control | Low — rules and terms are federally set | High — design and coverage determined by captive owners |

| Main limitation | Deductibles leave frequent, smaller losses uncovered | Works best for larger farms or groups with enough resources |

Captive Resources

Articles

Strategically insuring your farm? The rise of microcaptive insurance by Cory Walters for Nebraska Farmer (March 6, 2025)

Webinar Recording

Captive Insurance for Farmers and Ranchers: Strategically Preparing for the Unexpected

This webinar features Dr. Cory Walters from UNL's Department of Agricultural Economics, hosting Nebraska farmers Phil and Nolan High, who share about their experience with insurance captives on their farm. It was recorded on Jan. 17, 2025, as part of the Center for Agricultural Profitability's webinar series.

This material is based upon work supported by USDA/NIFA under Award Number 2023-70027-40444.