Cornhusker Economics April 8, 2015Financial Outlook for Production Agriculture in Nebraska

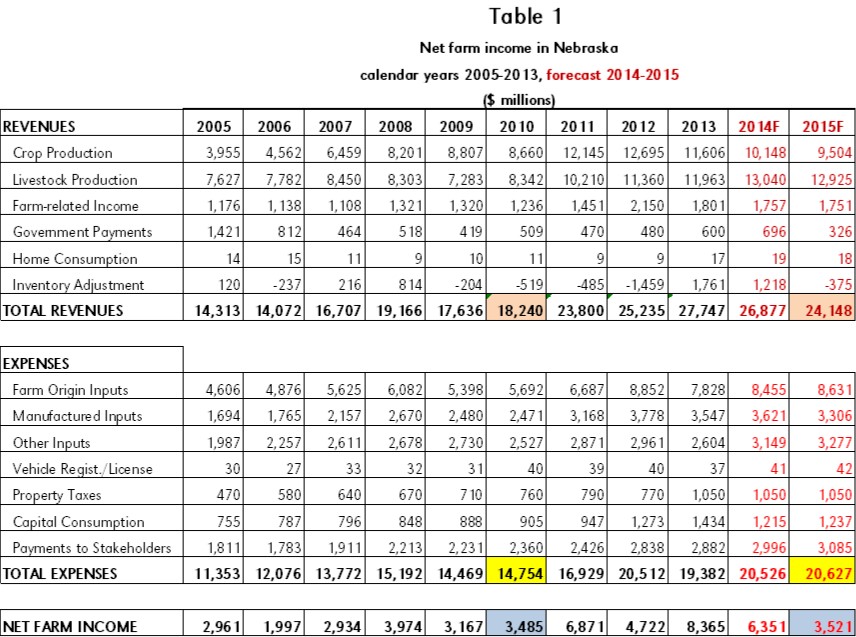

Based on February calculations, net farm income in 2015 for Nebraska is expected to decline from $6.35 billion in 2014 to $3.52 billion in 2015. This article discusses the 2015 outlook for crops, livestock and government payments as well as the Nebraska Farm Income projections.

Crop Outlook

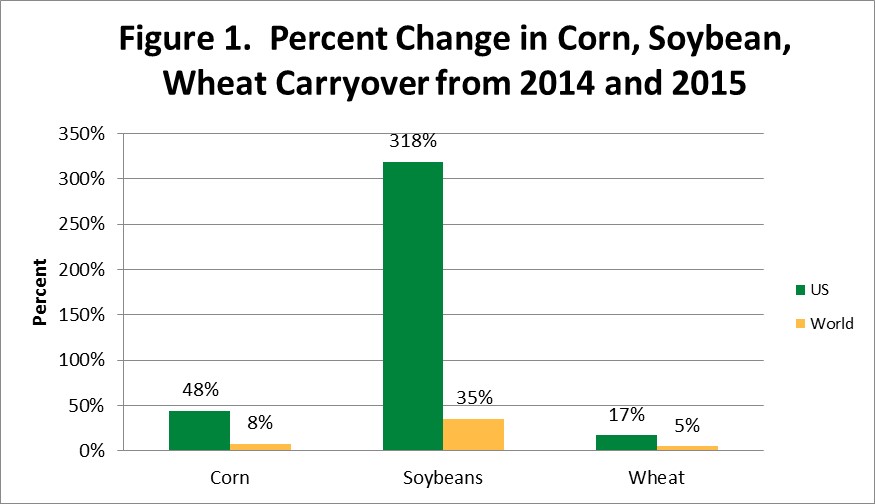

Underlying fundamentals for the 2015 crop year are drastically different than at this time a year ago. A year ago soybean prices were supported by low carryout stocks, which through demand for additional soybean acreage supported corn prices. This is not the case heading into the 2015 planting season. Both the U.S. and global level soybean carryover stocks have rebounded to ample amounts (increase of 318% in the US and 35% globally), corn carryover stocks grew (48% in U.S. and 9% globally) for the second time in a row, and wheat carryover stocks grew (17% in U.S. and 5% globally), Figure 1. As a result of the increase in carryover stocks, cash receipts from crops in Nebraska for the 2015 crop year are forecasted to drop to $9.54 billion from $10.15 billion in 2014, Table 1. Both corn and soybean cash receipts are expected to drop while wheat is expected to increase1. The reason for the increase in wheat cash receipts is due to uncertainty about crop condition when exiting dormancy. Recent evidence of winterkill lowers wheat cash receipts through lower yield, but this impact would be tempered with the recent rally in wheat prices. Growing season weather will play a critical role in determining final crop cash receipts.

Livestock Outlook

The livestock industry has seen big changes in the last couple of years with historically high prices. As we move into 2015, prices in the beef industry remain high while prices in the hog industry are lower than 2014. In the U.S., both the beef and the pork industries are marked for expansion through 2015, but due to biological constraints it will take longer within the beef industry. Within the beef industry, drought conditions over the last several years caused further liquidation of herds, driving beef prices to historically higher levels. Nebraska's beef cow numbers have been declining since the peak in beef cow numbers on January 1, 2012 at 1.88 million cows to 1.79 million cows on January 1, 2015. These declines in beef cow numbers translate into a decline of 4.2% in calf crop numbers from 2013 to 2014. Beef prices early in 2015 are expected to be higher than in 2014, but may move below 2014 prices during the fall with average prices near or slightly above 2014 prices. Changes in the livestock industry are expected to cause cash receipts from livestock in Nebraska to fall slightly from $13 billion in 2014 to $12.9 billion in 2015, Table 1. Cattle and calves cash receipts are expected to increase in 2015 with slight declines in hogs, poultry, and dairy. Demand will play a key role in prices for the livestock industry throughout 2015 as well as continued drought improvements for the beef industry.2

Government Payments

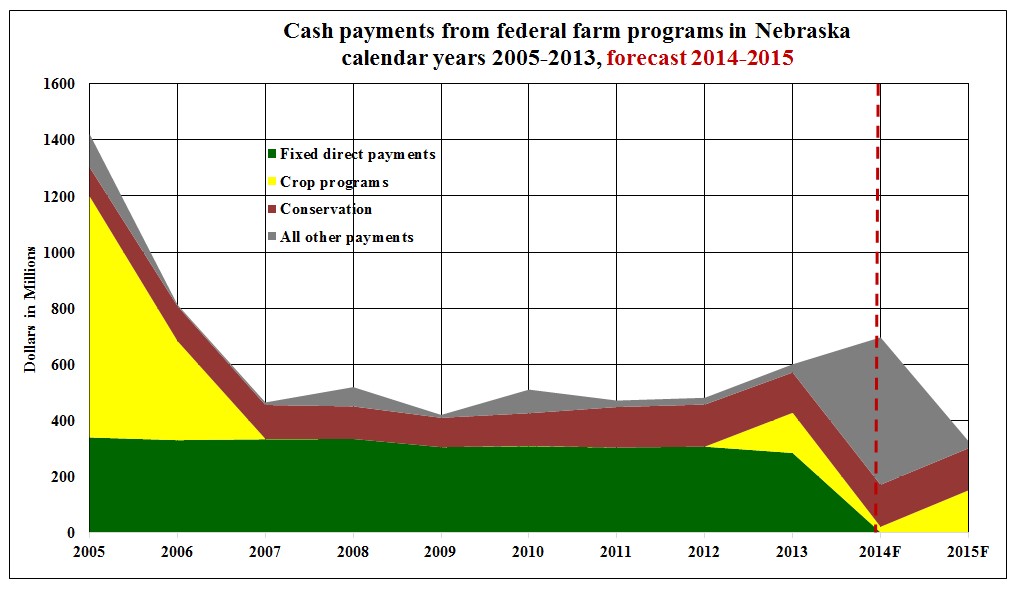

Expected government payments in 2015 are projected at $326 million, a steep drop from nearly $700 million in 2014 and $600 million in 2013, Figure 2. Policy changes in the 2014 Farm Bill and the timing of the bill both contributed to significant swings in government payments. The 2014 Farm Bill eliminated the fixed, guaranteed payments to crop producers in 2014, amounting to about $300 million per year. New crop programs are expected to provide substantial payments on the 2014 crop, but not until October 2015. As a result, total crop program payments (including fixed payments) fell from $426 million in 2013 to an estimated $20 million in 2014 before they are projected to rebound to an estimated $150 million in 2015.

The 2014 Farm Bill also brought a return of disaster assistance programs, primarily for livestock producers. Previous disaster assistance programs had expired in 2011 and the delay in a new farm bill from 2012 to 2014 meant the absence of disaster assistance programs as drought and other agricultural disaster losses accumulated. The 2014 Farm re-authorized disaster assistance programs retroactively back to 2011. As cumulative losses were tallied, disaster assistance payments jumped from $28 million in 2013 to an estimated $525 million in 2014 before they are projected to fall back to a more typical $25 million in 2015 barring any major agricultural disaster events.

Revenue, Expenses and Net Farm IncomeTable 1 presents cash receipts from crop and livestock production showing substantial increases over time. In contrast, government payments have declined. Total revenue in 2005 was $14,313 million and the forecast for 2015 is $24,148 million - a 69% increase.

Expenses have also gone up. Farm origin, manufactured and other inputs, along with capital consumption and payments to stakeholders, are each forecast to be one-and-a-half to almost two times greater in 2015 than ten years earlier in 2005.

Revenue in 2014 and 2015 for the major crops and livestock came from the cash receipts documented earlier. The other line items for both revenue and expenses came from Nebraska's long-term average pro rata shares of USDA's national forecast for the same. As a result, the changes in cash receipts (revenue) for the major crops and livestock accounted for most of the changes in total revenue and net farm income from 2014 to 2015.

Net farm income for 2015 is forecast to be $3,521 million, which is substantially lower in the prior four years, and close to the $3,485 million in 2010.

Kate Brooks

Assistant Professor

Ag Economics Department

kbrooks4@unl.edu

Cory Walters

Assistant Professor

Ag Economics Department

cwalters7@unl.edu

Brad Lubben

Assistant Professor

Ag Economics Department

blubben2@unl.edu

Dennis Conley

Professor

Ag Economics Department

dconley1@unl.edu