When the Tax Cuts and Jobs Act (TCJA) was passed in 2018, a lot of time and focus was placed on all the things that were changing quickly and the things that were 5-6 years out became back-burner problems. Amazingly enough, we are now at the stage of the bill where things are starting to phase out. These changes will start to impact tax returns starting in 2023 and will continue increasing taxable income through 2025.

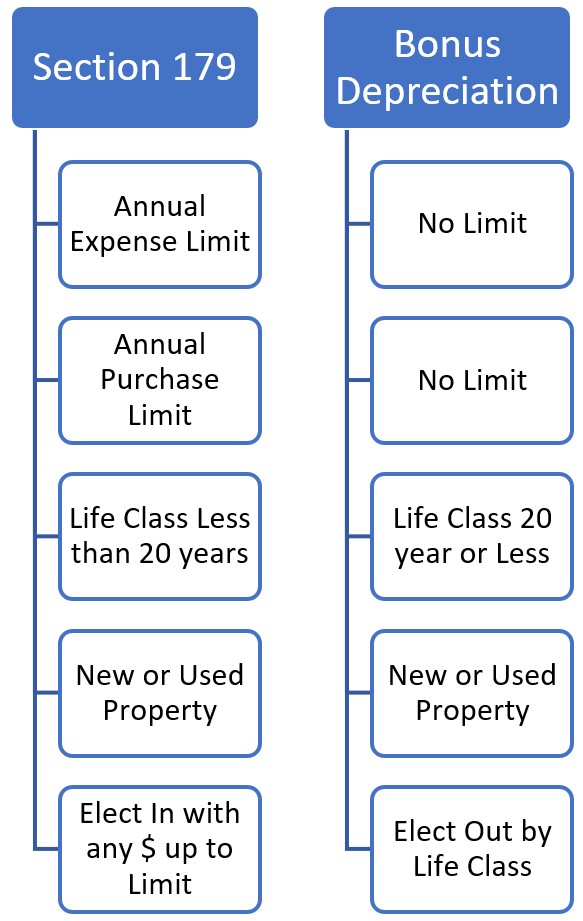

The first change is the phase out of the Bonus depreciation. This law has been on the books since 2001 (there was no Bonus in 2007) and has ranged from 30% - 100% throughout that time. Bonus depreciation is often confused with Section 179 which also allows for the expense of capital assets in the year of purchase but there are some significant differences.

Section 179 of the law has two limits. The first is the expense limit. The TCJA raised that from just over $500,000 to $1 million.

Section 179 of the law has two limits. The first is the expense limit. The TCJA raised that from just over $500,000 to $1 million.

Section 179 has always intended to be a small business tax deduction. As a result, there is also an annual purchase limit to keep large businesses from using it. The TCJA raised that from just over $2 to $2.5 million. This limit reduces the expense limit $1 for $1. So, if you spend $3 million on qualifying equipment, your expense limit would be reduced by $500,000 ($3 million - $2.5 million) to $500,000 ($1 million limit - $500,000 overage on the purchase limit).

The Section 179 changes made by the TCJA were made permanent and were indexed for inflation, so those amounts are increasing each year. Remember in tax law, permanent just means until they change it again, but there is no scheduled phase out or removal.

Bonus depreciation has been used by Congress to encourage spending by all businesses when the economy has needed it so there is no purchase limit and no expense limit. If you buy $10 million worth of equipment, you can write off $10 million in the year of purchase.

There are other differences between the two including the life classes that qualify and how you elect in or out of the deduction, but they are not major in this discussion.

The TCJA reinstated the 100% bonus depreciation for tax years 2018 – 2022 and then created a phase out starting in 2023 at 80% and then reducing by 20% a year through 2026 with elimination in 2027.

Great, so what does this mean?

For many farm and ranch operations, this reduction will not mean a lot. Many operations’ annual purchases are well under the $2.89 million purchase limit for 2023 and can get all the benefits of first-year depreciation from Section 179. Their biggest impact will be that farm buildings qualify for Bonus depreciation and not Section 179. For the past 4 years, if you built a new machine shed, you could write off the purchase cost of that building in the year you built it instead of using the regular depreciation schedule which will take 20 years to take that full purchase cost as a deduction. For 2023 you can write off 80% of the cost.

For operations that spend more than $3 million, there may be a big shock this fall to your tax planning.

One of the other many significant changes made by the TCJA was the elimination of the ability to make a Section 1031 like-kind exchange for non-real property. Most people didn’t even know they were doing a 1031 exchange every time they traded tractors but that was the law that allowed for the boot paid (difference between the purchase price of the new asset and the trade-in value of the old asset) to be added to the remaining value of the traded asset to establish the basis in the new asset.

You can see the net difference between both is still $90,000 but the new rules change the way a tax return looks for sure. For one, the dollars that counted toward the Section 179 limit before the TCJA was $90,000 and today it is $250,000 for the exact same asset purchase so operations hit that purchase limit today that would never have had a problem in 2017. Also, the $160,000 gain is reported on Form 4797 while the depreciation expense is reported on Schedule F. It has not been uncommon since 2018 to see large gains on Form 4797 and large losses on Schedule F as we have used both Section 179 and Bonus depreciation to offset the gain recognized by the new treatment of traded assets.

One of the many impacts this makes to the tax return will become glaringly obvious in 2023 for operations that are limited on their use of bonus deprecation and are over the purchase limit to use Section 179.

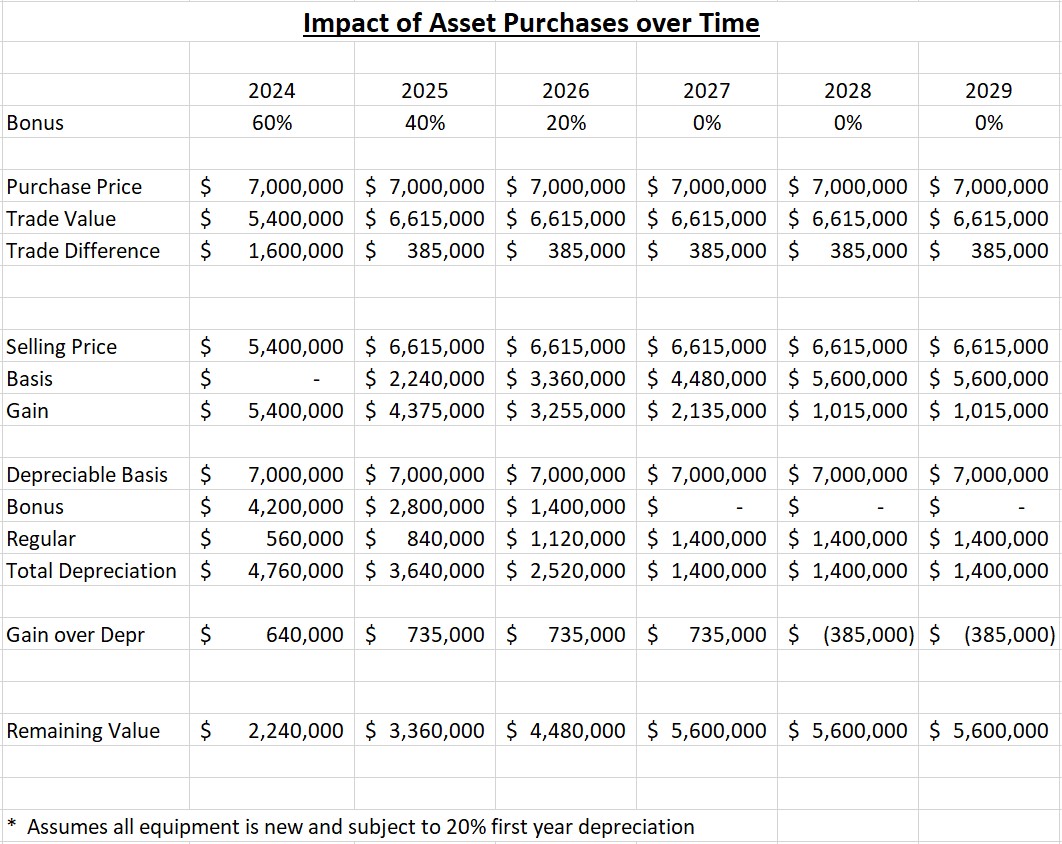

The following chart is an example of purchasing a significant amount of equipment and rolling that each year, which keeps the annual equipment cost (trade difference) at a reasonable level, but the tax implications of this will be painful over the next few years.

Each year, the producer purchases $7 million of equipment. After the first year, the trade difference (cash boot paid) would only be $385,000. Each year on the tax return, the assets that were purchased the previous year would have to be “sold” on the return. The trade value would be the selling price. Assuming they have no current basis in equipment (have used full 179 and bonus in the past) the gain (taxable amount) the first year would be $5.4 million. This example starts in 2024 when bonus deprecation will be limited to 60% so the taxpayer will have to recognize a $5.4 million gain and can only use deprecation of $4.76 million to offset it showing a $640,000 taxable income before any other farm or non-farm income. The next year, there is remaining value (the amount you did not get to depreciate in year 1) that is deducted from the selling price of the equipment traded in 2025, but with the reduction of bonus depreciation to 40%, the net gain recognized is $735,000.

This is really a transition problem as eventually it will work that the remaining value will be more than the gain on the sale of the assets. On the other hand, depreciation will not be able to be a tool we use to manage other farm income. This level of income could be subject to an income tax of 35%, a Net Investment Income tax of 3.8% and state income taxes.

These numbers may seem incredibly large to you but with the push to consider purchasing programs that give discounts for ordering multiple units at one time and rolling those each year, they are real numbers for many producers.

One of the solutions that is being talked about a lot is moving to leasing equipment instead of purchasing. This may be a workable solution to reduce the amount you are spending on qualified purchases and get under the Section 179 limit. It is important though to make sure you are talking about a true lease in the eyes of the IRS. The IRS considers many leases available today as a conditional sales contract instead of a lease, in other words, they are just fancy financing arrangements. Some of the factors to consider if your lease is really a conditional sales contract include:

- Your payments increase your “equity” in the asset. A lease does not build equity.

- The asset becomes yours when you make the final payment.

- If the amount you pay to use the asset is the same as the purchase price (for example, five lease payments are close to the same as five principal & interest payments to purchase the asset).

- If the lease buyout is not a fair market value buyout. If instead a final payment is the buyout, it is not really a lease.

- If there is an inputted interest rate in the lease payments. A true rental arrangement would not have interest calculated into the payment.

Most lease companies will tell you their leases are true leases and that they have never had a question on audit but just because there has not been an audit does not mean they are true leases, and it also does not mean there would not be one in the future. If you were the one audited, and the move from a lease to a purchase would put you over the limit, your return would be impacted by moving the lease payment to depreciation (roughly a reduction of 85%) plus if it puts you over the Section 179 limit and you lose that $1 million deduction, the underpayment penalties will be significant in addition to the past due tax.

This change in the tax law is certainly highlighting one of the many “catch you later” problems with accelerated depreciation, but for those who are not prepared, the surprises of a reduction in bonus depreciation could be big. It will be important to talk with your tax preparer about how these changes may impact your tax plan starting in 2023 if you purchase a significant amount of equipment.

Tina Barrett

Program Manager

Nebraska Farm Business, Inc.

tbarrett2@unl.edu

402-464-6324