Cornhusker Economics September 16, 2015Ethanol, Gasoline and Ethanol Prices

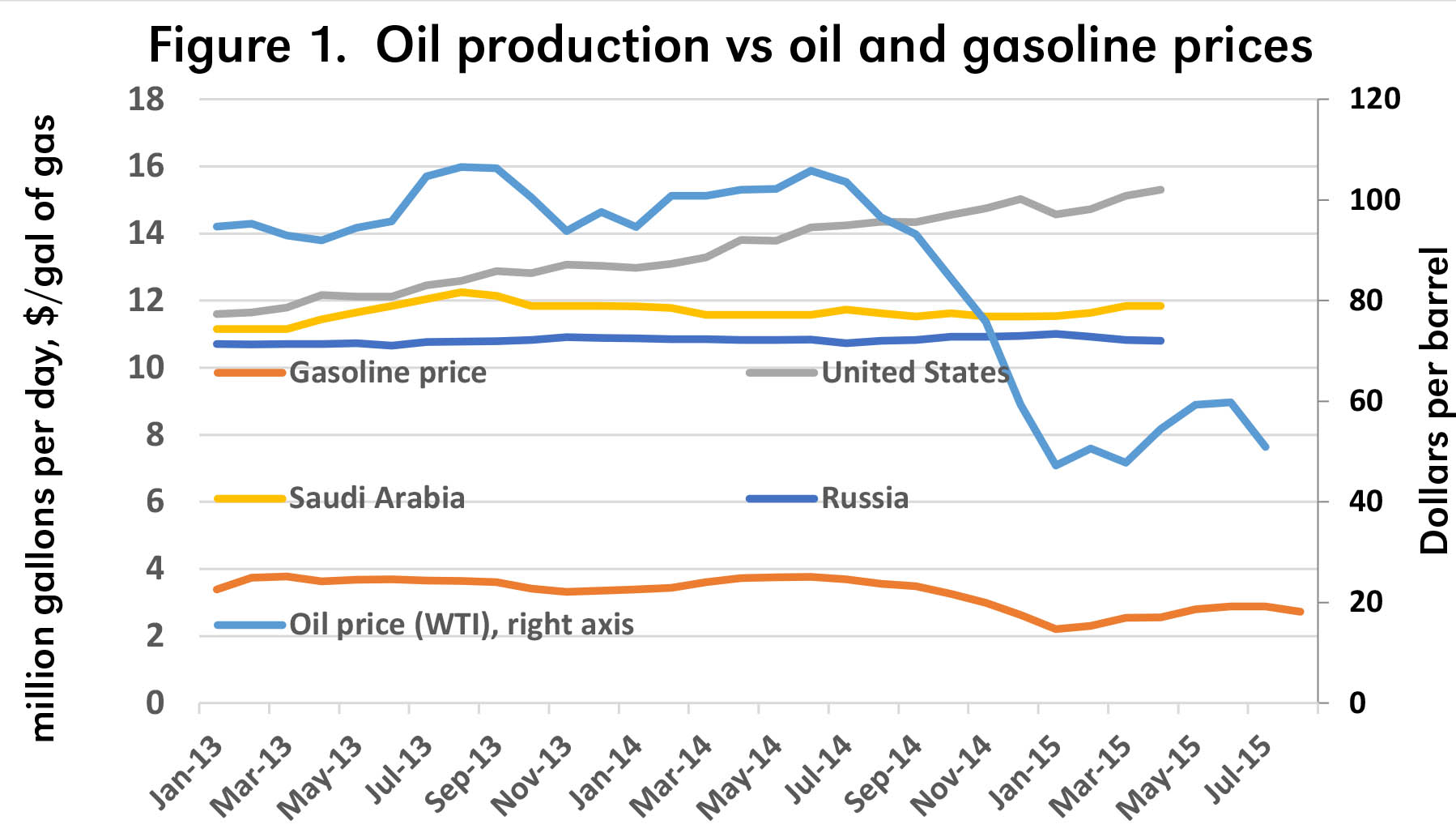

The price of crude oil took a steep dive last year, plunging from $95 per barrel just a year ago to the low $40-range by December, where they remain today (Figure 1). Goldman Sachs has recently suggested that it could drop further, even into the $20 range. Low oil prices mean low gasoline and ethanol prices.

The fundamentals behind the oil price drop, as I mentioned in this space a year ago, are the dramatic increases in oil pumped by the United States (Figure 1) on the supply side, and the generally sluggish world economy on the demand side. But those factors didn't just appear in September last year, so what's going on?

First, it takes time for fundamentals to work through the fog of market uncertainties. But beyond that in the oil markets, Saudi Arabia plays a heavy role by intentionally changing its production to affect price, obscuring or offsetting the effect of fundamentals for a time. Traditionally, their intent was to stabilize prices.

Notice from Figure 1 that the Saudis substantially increased their output during mid-2013, widely viewed as an effort to reduce the world price, which was around $100/barrel at that time. Presumably, lower prices would discourage continued increases in production from the new oil sources in the United States. Consistent with that view of their behavior, they began reducing output as the price fell below $100.

But oil price began another steady rise through the first half of 2014. This time, the Saudis began to cut their production a bit, but United States production continued to increase robustly. By then, sluggishness in the Chinese economy had become apparent. These two trends should bring oil prices down. Still, the outlook was not clear – whether the Chinese economy would falter seriously, whether United States output would continue to increase at the same pace, and what the Saudis would do in either case.

By October, the answers became more evident to the trade, leading to the price collapse. In response, not only did the Saudis maintain output rather than reduce it to support the price, from early 2015 onward they began to increase output. While this helped them to maintain their revenues, the trade has characterized it as an ongoing effort to lower the price in order to drive new United States producers out of the market.

Along with the increase in United States and Canadian production, and the prospect of increasing exports from Iran, the world is awash with oil. World economies remain sluggish, with diminished demand for oil and no prospects for any quick turnaround. It seems that only increased turmoil or outright war in the Middle East would bring the price up significantly in the coming months.

What does low oil price mean for gasoline prices? Prior to this year, whenever the oil price has been below $50/barrel, average monthly United States gasoline price has been below $2/gallon. We should expect to see $2 gasoline at the pump soon (see Scott Irwin and Econbrowser).

Low gasoline prices will be welcomed by Nebraska motorists. But that will bring ethanol prices down as well, meaning tough times for the huge Nebraska ethanol industry. With the price of corn at roughly $3.60 per bushel, the net feedstock cost is about $0.90 per gallon of ethanol produced. Add another $0.50/gallon of variable costs, and plants need to get about $1.40/gal just to keep operating, with no return for capital. Last week, they were being offered $1.35-1.45.

The continuing slide of gasoline price from the current $2.35 or so toward the $2.00 point will put further downward pressure on the ethanol prices. To make things worse for the plants, weaker crop prospects have recently sent corn prices on an upward path. Therefore, ethanol plant operating margins appear almost certain to go negative for many of Nebraska's plants over the next few months, leading perhaps to some shutdowns or production cutbacks.

Richard Perrin

Jim Roberts Professor

Ag Economics Department, UNL

rperrin1@un.edu, 402-472-9818