Cornhusker Economics Oct 11, 2023

Insurance, Policy, and Education for Livestock Producers

By Milan Chauhan and Brad Lubben

Federal crop insurance programs have existed since the 1930s, but for livestock producers, federal insurance programs were virtually nonexistent until the past 20 years. Livestock producers may not face exactly the same production risks that crop producers face, but they do face similar production risks related to grazing capacity and forage production and of course face price risks just like crop producers do.

Livestock producers other than dairy have also not had decades of commodity program supports that provide protection from low prices or revenue. They have benefitted from frequent disaster assistance programs, including programs for death losses and drought losses that are now permanently authorized and funded via the 2014 Farm Bill. However, they historically have not been a large part of the discussion around the role of a federal safety net of commodity programs and crop insurance programs.

That has changed in the past 20 years with new federally-supported insurance tools, increased policy incentives, and increased educational efforts that have made insurance products for livestock producers more available, more attractive, more understood, and much more utilized.

Insurance Products

The United States Department of Agriculture Risk Management Agency (USDA-RMA) supports private companies to sell insurance products to producers. The federal support includes premium subsidies to reduce the insurance premium costs for producers, contracted payment rates for insurance companies to deliver and service insurance products that are priced by the federal government at a rate targeted to equate total premiums with total indemnities over time, and reinsurance pools that provide companies protection against catastrophic losses in their insured portfolio.

Livestock insurance products mainly include Livestock Risk Protection (LRP), Livestock Gross Margin (LGM), and Dairy Revenue Protection (DRP), which protect livestock and dairy producers against price or margin losses. Products like Whole Farm Revenue Protection (WFRP), and Micro Farm policies also protect producers against revenue losses in diversified enterprises of both crops and livestock (USDA-RMA, 2022). Pasture, Rangeland, and Forage (PRF) and Annual Forage (AF) policies are equally useful for producers to mitigate risk against precipitation losses that would affect forage production and grazing capacity. Dairy producers also benefit from Dairy Margin Coverage (DMC), a commodity program by USDA-Farm Service Agency that works similarly to LGM and protects against the loss of dairy margin (USDA Farm Service Agency, 2022).

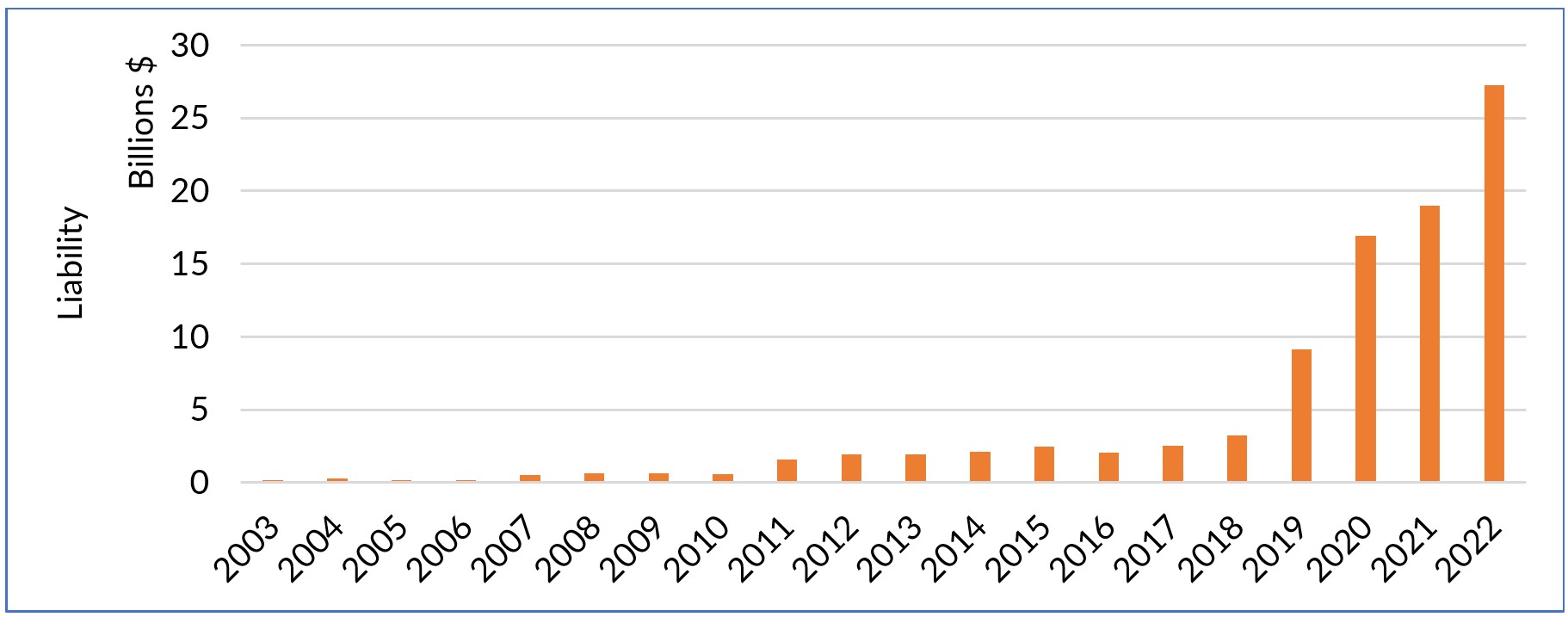

Figure 1 shows the exponential growth in the utilization of insurance products tailored for livestock producers. Measuring total liability, or the total value of production that is protected by an insurance policy, the figure shows coverage in force growing from millions of dollars 20 years ago to $27 billion dollars of coverage in 2022 for the five most relevant livestock producer products of LRP, LGM, DRP, PRF, and AF.

Figure 1. Liability of Insurance Products for Livestock and Dairy Producers

Policy Development

Livestock producers had no federally-supported insurance products until the Adjusted Gross Revenue (AGR) policy was introduced in 1999 as a whole farm revenue insurance option. AGR and its successor programs WFRP and Micro Farm have maintained the availability of a whole farm coverage product, but they remain a relatively small market to this point. The big shift for livestock producers came with the Agricultural Risk Protection Act of 2000 and the approval of LRP in 2001 and LGM in 2003. Participation in LRP had grown slowly for many years, but the increase in the federal premium subsidy rate from 13% to 20% in 2019 as a result of the 2018 Farm Bill and then two further increases in 2020 to a new subsidy rate of 35-55% along with elimination of a funding cap (Boyer & Griffith, 2023) have dramatically increased the attractiveness of and the participation in LRP.

In 2007, PRF was introduced utilizing a rainfall index (RI) or a vegetative index (VI) to provide protection based on remotely-sensed or satellite-sensed weather and growing conditions. PRF participation increased considerably after revisions in 2014 and the exclusive use of the RI. By the end of 2022, PRF covered over 247 million acres of perennial forage, rangeland, and pasture while Annual Forage (AF) covered around 5 million acres of annual production used for livestock feed or fodder.

For dairy producers, insurance product utilization really grew with the Agriculture Improvement Act of 2018 (the 2018 Farm Bill). Previously, dairy producers participating in what was the Margin Protection Program for Dairy under the 2014 Farm Bill were prohibited from utilizing the insurance products for dairy. The 2018 Farm Bill allowed dairy producers to participate in both DRP and the new DMC program. Not surprisingly, participation in DRP surged in the 2019-2022 period.

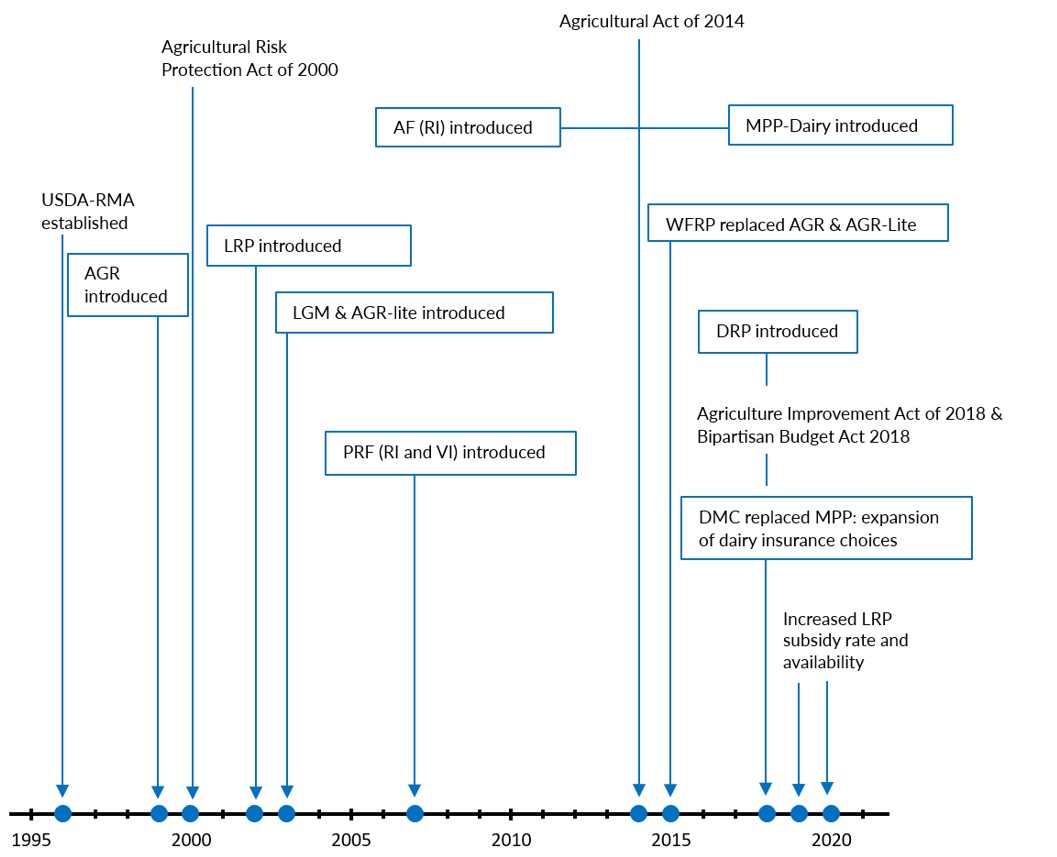

These substantial policy changes are highlighted in the timeline in Figure 2 along with major policy milestones. The introduction of several new insurance products and the numerous revisions or enhancements to insurance products created increased incentives and opportunities for producer participation. Couple the policy changes with increased market volatility surrounding major market shocks like a beef processing plant fire in 2019 or the COVID pandemic-related market and supply chain disruptions in 2020 and the value and attractiveness of insurance products to help producers manage risk grew even more, helping drive the increased participation demonstrated in Figure 1.

Figure 2. Timeline of Policy Changes Affecting Federal Farm and Insurance Programs for Livestock and Dairy Producers

Risk Management Education

While policy revisions and federal support have helped make insurance products increasingly attractive to producers, education has also played a role in introducing producers to the new products and changes and educating producers on how to use the products to manage risk on their operations. One indicator of the growing role of education is the Extension Risk Management Education (ERME) program, a USDA National Institute of Food and Agriculture (NIFA) funded program. Through the program, NIFA competitively awards funds to regional centers (including the North Central ERME Center at the University of Nebraska-Lincoln) to in turn, competitively fund local producer-focused risk management education projects across each region.

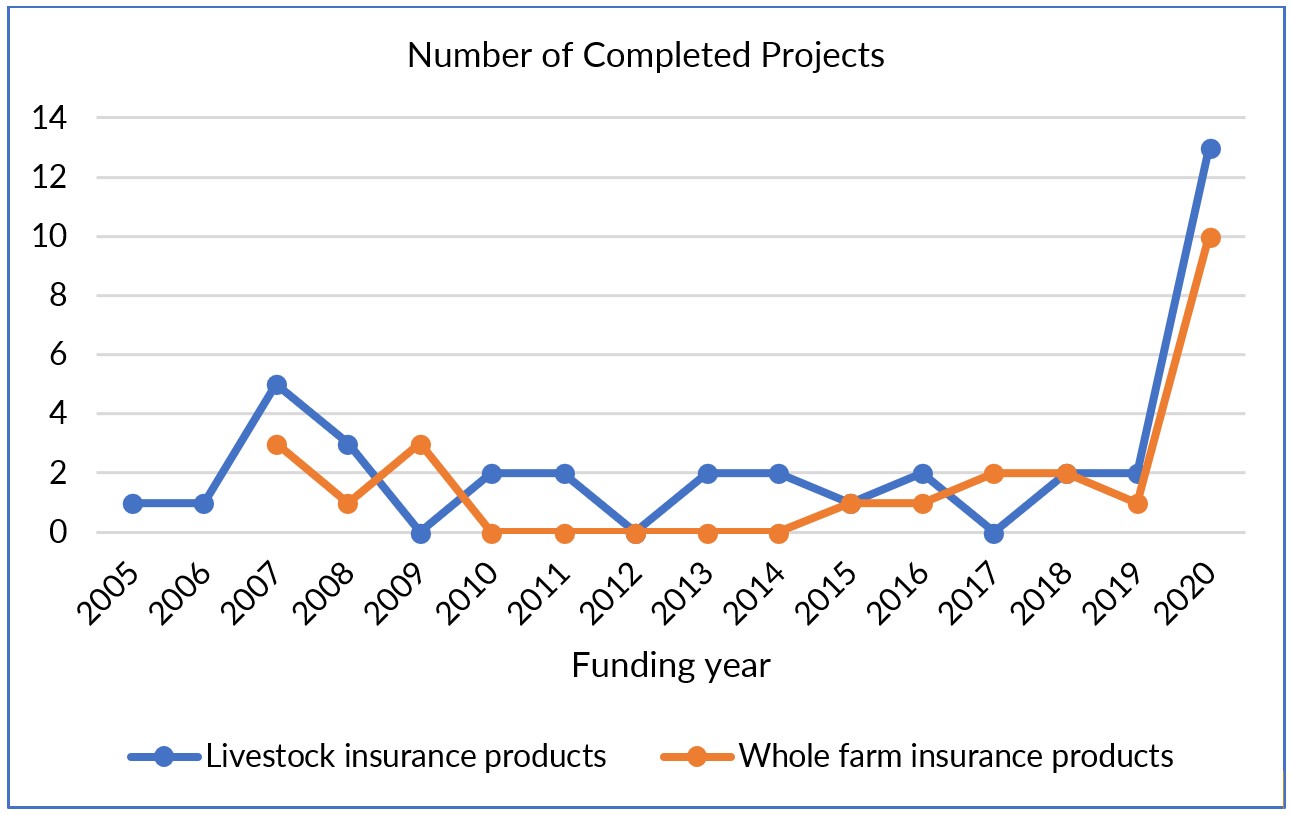

The number of projects funded across the country through the ERME program provides another indicator of growth in both the interest in insurance products for livestock producers and the education targeted to increase producer understanding and utilization of those products. Figure 3 shows the number of funded projects by year of funding, with a sharp increase noted in 2020. This increase too is related to a policy change as the ERME program was charged by the 2018 Farm Bill with awarding a new pool of funds to projects that specifically targeted producers historically underserved by federal crop insurance programs (including livestock producers). The growth in funded projects that specifically addressed livestock-related insurance products or the more general whole farm insurance products can be expected to translate into further producer understanding and utilization of the relevant insurance products over time.

Figure 3. Completed Educational Projects on Livestock and Whole Farm Insurance Products Funded Through the Extension Risk Management Education Program

The ERME program is not the only source of funding for educational efforts on insurance products for livestock producers as additional programs from RMA, NIFA, or other public and private efforts are increasingly reaching producers with relevant information. However, it does provide a good indicator of the educational efforts involved and the substantial growth in efforts in recent years.

While there has been substantial growth in participation, there is still substantial room for more utilization. The DRP and LGM policies for dairy currently cover just about one-fourth of total milk production in the United States. The LRP and LGM policies for cattle and hogs cover less than 10% of production. In contrast, PRF has grown to the point that it covered nearly 250 million acres in 2022, accounting for more than half of U.S. pasture and range acres (Lubben, 2023). Further policy changes and continued educational efforts may help producers to explore and benefit from these products in order to mitigate risks in their farm or ranch operations.

References

Boyer, C. N., & Griffith, A. P. (2023). Subsidy Rate Changes on Livestock Risk Protection for Feeder Cattle. Journal of Agricultural and Resource Economics, 48(1), 31-45. doi:10.22004/ag.econ.316752

Lubben, B. (2023). "Insurance tools for livestock and dairy producers." Nebraska Farmer. May 10. Retrieved from https://www.farmprogress.com/commentary/insurance-tools-for-livestock-and-dairy-producers

USDA Farm Service Agency. (2022). Retrieved from https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/2022/dairy_margin_coverage_program_2022_fact_sheet_october.pdf

USDA-Risk Management Agency. (2022). Retrieved from https://www.rma.usda.gov/Fact-Sheets/National-Fact-Sheets/Whole-Farm-Revenue-Protection