Cornhusker Economics September 25, 2014

Nebraska: Asymmetric Information in Crop Insurance

Increasingly agricultural policy has turned from direct counter-cyclical commodity programs toward social insurance and risk management programs. Congress attempted to entice producer participation in the crop insurance program by increasing premium subsidies and introduction of new crop insurance contracts through the Agricultural Reform Act of 1994 and the Agricultural Risk Protection Act of 2000. Higher subsidies and expanded contract options helped fuel an increase in insured acreage. Insured acres increased from 100 million to 265 million between 1994 and 2009 (USDA-RMA Bulletin). Also, during this timeframe other undesired outcomes may have emerged. Subsidized and complex crop insurance programs may increase the likelihood that profit-maximizing producers can use information advantages to garner returns above what the government intends. The excess returns would result in increased costs to taxpayers and potentially inefficient reallocations of resources in agriculture.

The root of inefficiency in insurance lies in asymmetric information. These inefficiencies are generally subsumed under the categories of adverse selection (or anti-selection) (Akerlof 1970) or moral hazard (Arrow 1985), or both. An example of adverse selection would be the purchase of crop insurance (provision) where the insured has information unknown to the insurer, and so can obtain excess expected returns. Essentially, the insured is using loaded dice, and the insurer does not know it. Moral hazard occurs when participants change their (risky) actions when insured ’- for example, by adopting more risky inputs or crop regimes. In agriculture the boundary between choosing to participate in insurance programs versus altering management practices because of participation can be ambiguous -- since often the insurance provision decision and the operational production decisions occur simultaneously. Hence, it is often difficult to distinguish empirically between adverse selection and moral hazard (Quiggin, Karagiannis, and Stanton 1993). In this study, we were not concerned about the category of behavior (i.e., adverse selection or moral hazard), but only whether and to what degree such actions occur. Hence, we use the generic term "opportunism" and "opportunistic behavior" to indicate either or both forms of (rational, profit-maximizing, but inefficient) behavior under information asymmetry.

To address several issues faced by insurance program designers and administrators, we empirically examined some recent crop insurance experience. We examined whether insurance contract characteristics stray from the neutral revenue impacts one would expect from actuarially neutral insurance (i.e., with premium rates set to cover expected costs under complete information) beyond the impact of subsidies and, if so, by how much. We looked for evidence of such deviation by examining returns to particular features of insurance. If variation in unit-level crop insurance returns (other than the subsidy) is systematically associated with insurance contract characteristics or with geographic region for a representative time period, then either the insurance is not actuarially neutral or the subsidy is not implemented according to policy. Either case would permit participants to exploit opportunities within the insurance system to make profits, e.g., by exploiting contracts that are too cheap relative to those that would emerge under neutral insurance. We investigated whether producers using different insurance contracts (including buy-up coverage, unit type, revenue insurance, and T-yield) may have strategic advantages in their contract selection.

Data

The data included observations of crop insurance contract information and corresponding performance records for all insured units by the Federal Crop Insurance Corporation ( FCIC) for each of 14 years ’- 1996 through 2009. Only insured units are included in the data set. Producers can change insurance contracts on each unit from year to year. The data set includes all information the FCIC has for each crop insurance contract: indemnity amount, premium paid by producer, amount of subsidy, crop type, number of acres, field practice, coverage level, unit type, insurance type, year, county location of unit, and type of APH (actual and/or T-yields). We conducted our analysis using data for five different growing regions, two with relatively homogenous within-county land resources (Iowa and Western Nebraska) and three with more heterogeneous land resources (Oklahoma, North-Central Montana, and Eastern Washington). To permit an examination of the effects of the heterogeneity of land resources, we limited our data sample to non-irrigated agricultural production. Even with the limited number of regions and considering only non-irrigated production, the data set includes a total of 392,035 observations.

We conducted our analysis using data for five different growing regions, two with relatively homogenous within-county land resources (Iowa and Western Nebraska) and three with more heterogeneous land resources (Oklahoma, North-Central Montana, and Eastern Washington). To permit an examination of the effects of the heterogeneity of land resources, we limited our data sample to non-irrigated agricultural production. Even with the limited number of regions and considering only non-irrigated production, the data set includes a total of 392,035 observations.

Results

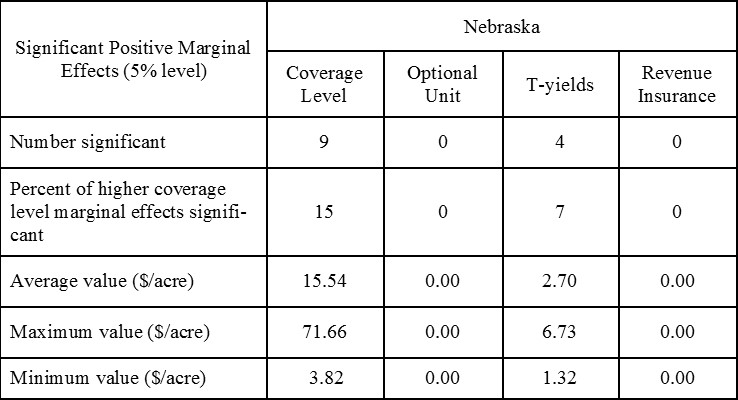

With space constraints I, as one of the authors, am focusing only on results from Nebraska. Statistics to examine the null hypothesis that producer selection of higher coverage levels (75% and greater), optional units, and revenue insurance did not provide evidence of opportunistic behavior are presented in Table 1. Significant positive marginal effects of coverage level by crop and practice provide evidence of the exercise of opportunistic behavior in an otherwise neutral insurance market with the subsidy implemented consistent with policy. In Nebraska the percent of positive coverage level marginal effects that were significant at the 5% level was 15%. The average magnitude was $16 per acre with a maximum of $72 per acre and minimum of $4 per acre. The average magnitude exceeded the average indemnity ($8 per acre) over the study period. There was no evidence of opportunistic behavior in the optional unit and revenue insurance selection in Nebraska. Nebraska demonstrated evidence of opportunistic behavior from the use of T-yields. Nebraska had 7% of significant positive T-yield marginal effects. The average, maximum and minimum values of these marginal effects were lower than for higher coverage level selection. Findings suggest that the potential exists for producers to profit by selecting higher coverage levels and/or by the advantageous use of T-yields.

Reducing producer opportunism would create a more cost-efficient risk management program that would limit the ability of producers to extract net profits from participation beyond the intentional subsidy provided to induce higher rates of participation. In Nebraska two of the four decision categories demonstrated evidence of significant producer opportunism. The exceptions were the use of T-yields and the decision to purchase revenue insurance. Relative to average indemnities, the magnitudes were often quite large.

Opportunism was judged through an assessment of subsidy-adjusted net profits since actuarially neutral insurance with no asymmetric information should produce zero profits beyond the intentional subsidy used to induce participation. Given an efficiency goal, our finding suggests that an increase in rates for higher coverage levels and a restructuring of the T-yield system is warranted to decrease the effect of producer opportunism. However, the results do not support the hypothesis that producers profit by selecting revenue insurance (and optional units in Nebraska), nor that high levels of government "incompetence" exist in the design and administration of the crop insurance system.

The manuscript was printed in the Journal of Applied Economics Perspectives and Policy and can be found here. For questions about the manuscript please contact Cory Walters.

Cory Walters, Assistant Professor

Oilseed and Biofuels Economist

Department of Agricultural Economics

University of Nebraska-Lincoln

cwalters7@unl.edu

References

Akerlof, G. 1970. "The Market for 'Lemons': Quality Uncertainty and the Market Mechanism." Quarterly Journal of Economics 84:488-500.

Arrow, K. 1984. "The Economics of Agency in Principals and Agents: The Structure of Business." Pratt, J., and Zeckhauser, R., (eds.), Harvard Business School Press, Boston.

Quiggin, J., G. Karagiannis, and J. Stanton. 1993. "Crop Insurance and Crop Production: An Empirical Study of Moral Hazard and Adverse Selection." Australian Journal of Agricultural Economics 37:95-113.

U.S. Department of Agriculture, Risk Management Agency. A History of the Crop Insurance Program. Available online at: http://www.rma.usda.gov/aboutrma/what/history.html (Accessed September 2007)