Rising Interest Rates

What They Mean for You, and the Economy

There is arguably no bigger news to the United States’ Economy than when the Federal Reserve announces a change in interest rates. This is especially true when open market operations (buying and selling government securities to manipulate the interest rate) are being used as a corrective measure addressing either a recession or inflation.

I am fortunate enough to have been teaching economics on a full-time basis for 16 of the last 17 years. During that time, I have determined that economics is very easy to learn/understand, but even easier to misinterpret. This edition of Cornhusker Economics will address the overall implications of rising interest rates, as well as the implications for individual consumers and firms.

To begin, when the Fed Chairperson announces a rate change, a magic wand is not used to increase or decrease rates. Instead, the Fed uses its holdings of US government securities to manipulate the money supply. If the Fed desires a rate decrease, they buy securities on the open market. The sellers (banks) are now flush with loanable cash, driving rates down. When the Fed wants a rate hike, they do the opposite. In reality, the precision of open market operations makes the announcement of changes to the 1/100th of a percentage, all but a certainty.

The stock market’s reaction to the rate announcement is insightful to understand how interest rates are used to manipulate the overall economy. If the rate increase is less than expected (say a 25 BP increase instead of a 50 BP increase) the stock market will rise. If the rate increase is more aggressive, there will be an overall stock selloff, resulting in a lower overall stock market value.

Stock prices represent the discounted value of a firm’s future potential earnings. Believers in efficient markets will argue the volume of stocks traded represents complete information. That is, buyers and sellers of stocks have “baked-in” information. The price of an individual stock includes an expectation regarding interest rates. If the Fed’s interest rate change is unexpected, this new information causes stock prices to change as the new information would dictate.

These stock price changes are reflective of the Fed’s motives. Raising interest rates makes business investments (buying land, machinery, etc.) less profitable. For firms borrowing money to finance investments, the explicit interest rate creates a higher bar for investment revenues to clear; hence the term “hurdle rate.” Businesses that are self-financed face a higher implicit rate as well. For the first time in recent history, the rate of return on low-risk debt investments (CDs, etc.) is real and positive. For these businesses, the cost of borrowing is implicit, but real nonetheless. Overall, less business investment means less spending, lower output, fewer jobs, and most importantly, downward pressure on overall prices.

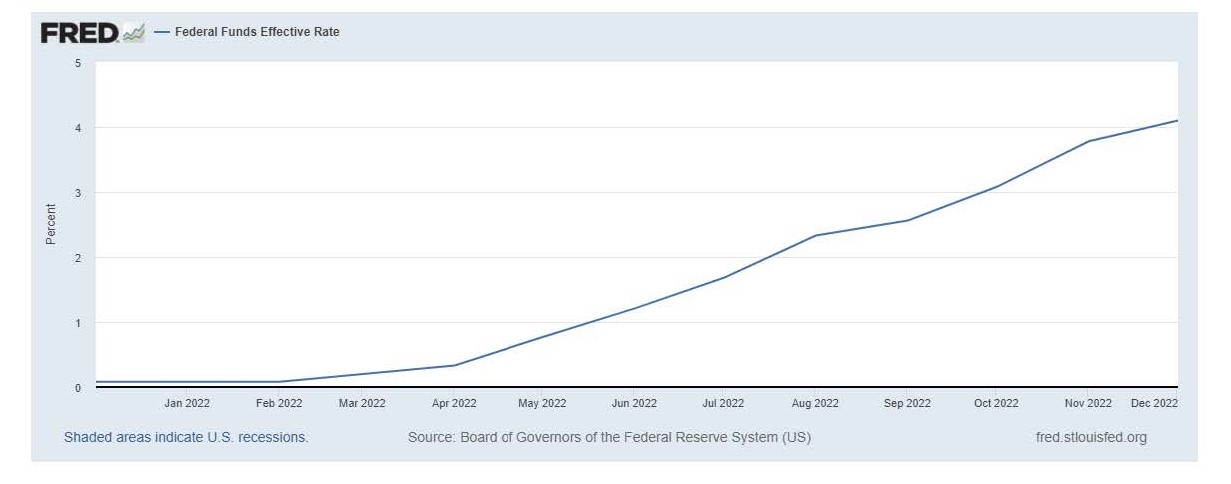

Interest rates have increased steadily over the past 12 months. For those with short memories, this trend seems to be uncommon, and highly concerning.

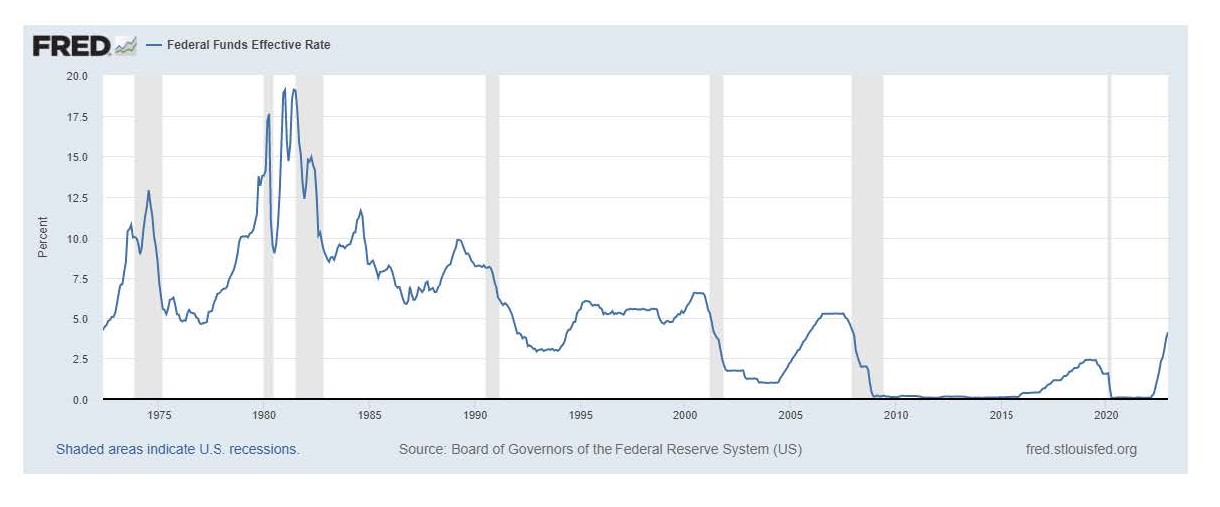

The graph pictured above reinforces the idea the sky is falling. However, when interest rates are visualized over a longer period of time, the current market scenario is not at all uncommon.

Just because it is not uncommon, does not mean it is not worrisome. The fact of the matter is that the Fed funds rate and all other interest rates have been historically low since the end of the financial crisis, aka “The Great Recession.” While 2009 doesn’t sound like that long ago, it is now 14 years in the past, an eternity in the lifespan of some businesses.

Pragmatically, this means that individuals and business owners alike are faced with a new variable: interest expense. The ramifications of increased interest expense are doubly harmful when the prices of real estate (land and buildings) do not decline. Take for example the principal and interest payment on a $500,000 real estate loan with typical terms (30-year, fixed-rate, fully amortizing). At today’s rate (6.7%) the monthly payment is $3223. At a typical rate from last year (3%), the monthly payment is only $2108.

Easy credit (and Wall Street) was certainly a main contributor to the Great Recession. However, the low rates that followed the recession have not obviously caused disruptions in the economy, despite what popular financial gurus have said. In short, people with spending problems will always have spending problems. For individual consumers and households, higher interest rates will hopefully be accompanied by lower prices. The immediate impact will be less borrowing.

A more interesting scenario will play out for businesses. Again, an entire generation has lived with low interest rates. Discrimination among investments simply was not necessary; all of them penciled out. This should be no surprise as the purpose of low interest rates is to encourage business investment. Higher rates will do the opposite.

Policy changes often have unintended consequences and I believe higher interest rates will induce a positive unintended consequence. CFOs, CEOs, Controllers, and other decision-makers will immediately re-evaluate cash flow and make obvious changes to operations. The best of these decision-makers will not shun additional investment. Instead, they will be able to apply superior management skills to discern the highest and best use of financial resources.

Economists believe the scarcity problem is best solved by free markets. Deciding what to produce with resources, how to produce it, and whom to sell it to is a result of the information that prices give us. Interest rates are simply the price of money and rising interest rates will funnel that money to the projects and investments that yield the best results for the business, and ultimately the economy as a whole.

Timothy Meyer

Associate Professor of Practice

Department of Agricultural Economics

University of Nebraska – Lincoln

tmeyer19@unl.edu

402-472-2314