Cornhusker Economics July 20, 2022

Use of Livestock Risk Protection Insurance for Cattle Continues to Grow

The USDA Risk Management Agency first made Livestock Risk Protection (LRP) insurance available for cattle producers in 2003. It remained relatively unchanged until 2018 when several enhancements and improvements began to take place. Those changes resulted in lower costs, increased access, and ease of use for producers using LRP. For example, over about a two-year period from mid-2018 to mid-2020, premium subsidies increased from a flat 13 percent to the current range of 35 to 55 percent. New and beginning producers receive an additional 10 percent subsidy on top of those rates. In 2020, the due date for premiums also moved from the beginning of the insurance period to the end of the insurance period, making it easier for producers to initiate the insurance coverage. These changes have resulted in a dramatic increase in the use of LRP across the country and, particularly, in Nebraska.

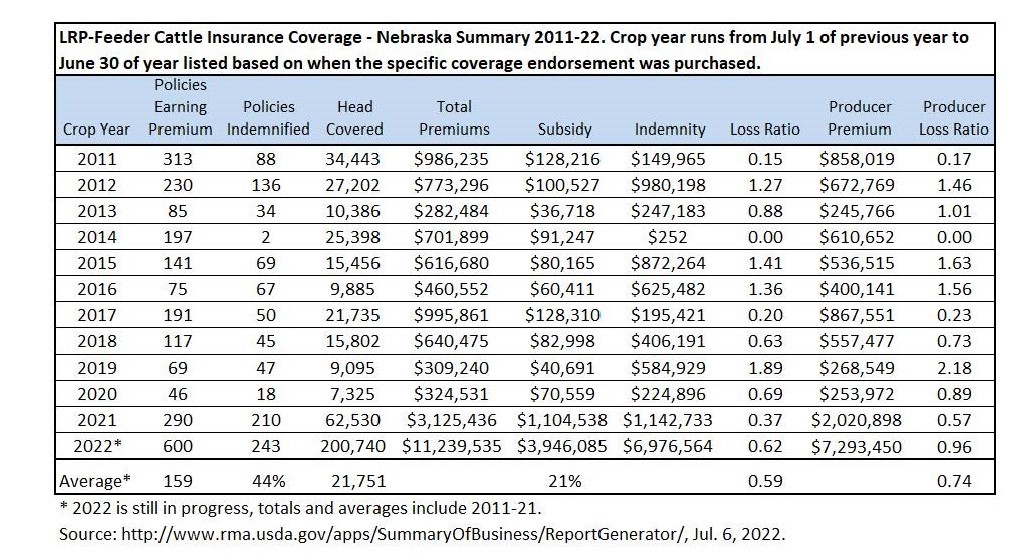

Table 1 contains producer participation data in Nebraska for the LRP-Feeder Cattle Insurance Coverage program from 2011 to 2022. LRP-Feeder Cattle insurance is available in five different forms for beef cattle: Steers Weight 1 (< 600 pounds); Heifers Weight 1 (< 600 pounds); Steers Weight 2 (600-900 pounds); Heifers Weight 2 (600-900 pounds); and, Unborn Steers & Heifers (< 600 pounds). It is also available for Brahman and dairy cattle. Table 1 shows the dramatic increase in sales and volume of cattle covered by LRP-Feeder Cattle insurance in Nebraska since the changes were finalized in early 2021. Over 200,000 head of cattle were covered by LRP-Feeder Cattle insurance in Nebraska for the 2022 crop year (purchased from July 1, 2021, through June 30, 2022). This is over three times as many feeder cattle insured than the previous year and 5.8 times the number of cattle insured in 2011, which was the previous record for most feeder cattle insured with LRP insurance in any one year prior to the changes starting in 2018. Many of the coverage ending dates for 2022 policies are yet to be reached so indemnity figures are incomplete but already indemnities nearly match producer premiums paid into the program.

Table 1: LRP-Feeder Cattle Summary of Business for Nebraska

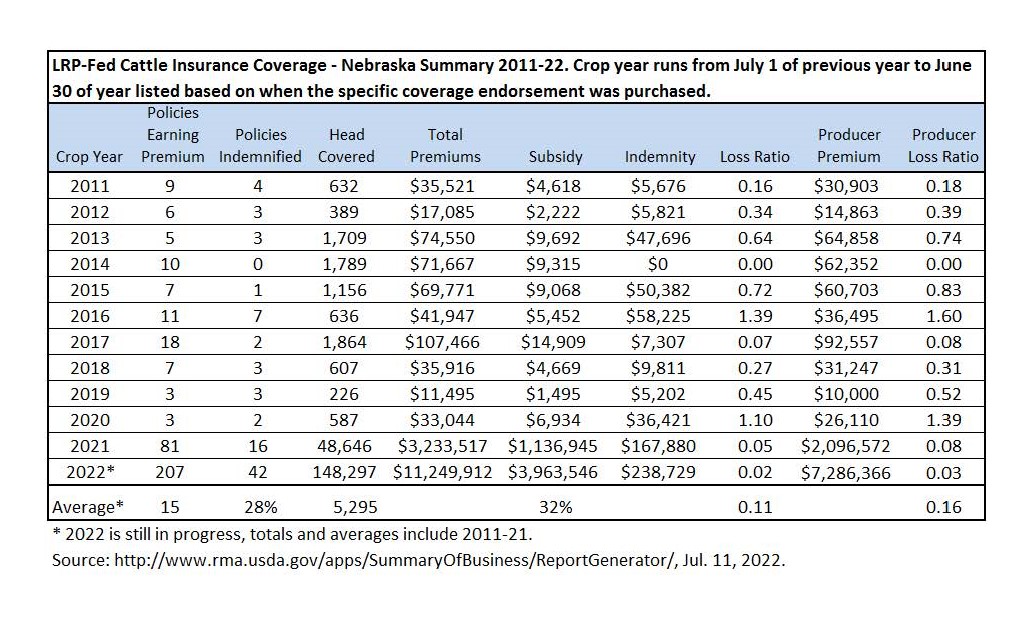

Historically, LRP-Fed Cattle insurance has not been as widely used as LRP-Feeder Cattle insurance. LRP-Fed Cattle insurance is for steers and heifers weighing more than 900 pounds. Whereas LRP-Feeder Cattle insurance is connected in price to the Chicago Mercantile Exchange (CME) Feeder Cattle futures contract, LRP-Fed Cattle insurance is connected to the CME Live Cattle futures contract. Prior to the 2021 crop production year, fewer than 2,000 head of slaughter cattle had been insured annually in Nebraska with LRP-Fed Cattle insurance. In the 2021 crop production year, the number of slaughter cattle in Nebraska insured with LRP-Fed Cattle insurance jumped to almost 50,000 head. The number insured tripled in the 2022 crop production year with 148,297 head insured across 207 policies.

Table 2: LRP-Fed Cattle Summary of Business for Nebraska

National LRP sales numbers for cattle follow a similar pattern to Nebraska sales numbers with one exception. The number of fed cattle in Nebraska covered by LRP-Fed Cattle insurance has historically been about 6-8% of the national total. For both 2021 and 2022, the number of cattle covered by LRP-Fed Cattle insurance in Nebraska represented about 25% of the national total. The number of cattle in the United States insured with LRP-Fed Cattle jumped from 8,098 head in 2020 to 180,660 in 2021 and 594,622 in 2022. While these increases seem dramatic, they are not as dramatic as the changes in Nebraska. Nebraska cattle covered under LRP-Fed Cattle insurance only made up 7% of the national total in 2020 compared to 27% in 2021 and 25% in 2022. The number of feeder cattle in Nebraska covered by LRP-Feeder Cattle insurance has historically been about 9-10% of the national total.

Like most insurance, cattle producers should not purchase LRP hoping to collect on it. All else being equal, strong market prices are preferred. For example, in 2014, the average Nebraska auction price for 500-600 pound feeder steers during the last three months of the calendar year climbed to over $300 per cwt. Under those circumstances, LRP insurance is providing price protection that is not needed. This is reflected in almost no indemnity payments to producers with LRP insurance for cattle purchased for the 2014 production year. However, the following two years saw prices drop from these historical highs and LRP insurance provided a nice price floor for those who purchased it to soften the impact of the declining markets.

When used as a regular part of a market risk management plan, LRP insurance can help protect profits in years where markets turn for the worse. The recent changes to the program have made LRP insurance more appealing to cattle producers and sales of LRP have subsequently increased dramatically. Strong price increases may make LRP unnecessary, but it is difficult to predict when the price increases will end. LRP insurance is a safety net, reducing downside price risk by providing a floor on national price expectations while also allowing producers to take advantage of higher national prices if they occur.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.

Jay Parsons, Professor

Farm and Ranch Management Specialist

Dept. of Agricultural Economics

University of Nebraska-Lincoln

jparsons4@unl.edu