Cornhusker Economics September 17, 2014

What To Do with Our Coming Oil Glut?

Glut? As motorists, none of us have observed the low prices that would accompany a gasoline glut. Yet, the US will soon face a glut of crude oil - the amount we will produce (along with imports) will exceed the amount we can process and transport.

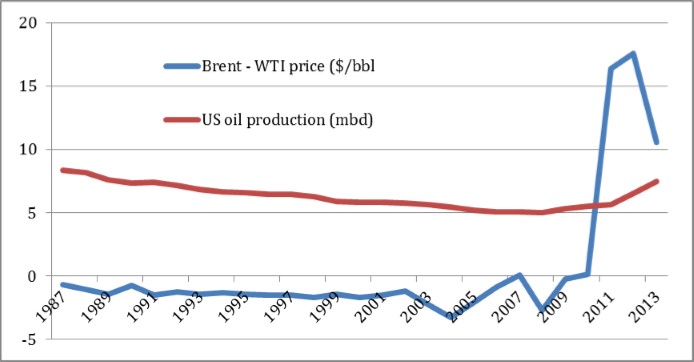

Evidence of the coming glut is the falling price of US petroleum relative to the world price. Since 2010, the price at Cushing, OK (West Texas Intermediate, or "WTI") has fallen to $10-15 per barrel below the world price, represented by the "Brent" price in Fig 1. Even within the US, the price at the new west Texas oilfields has fallen to $17 per barrel below the Cushing price, simply due to inadequate transportation infrastructure.

Fig. 1 - US petroleum production and the spread between US price and world price

Where is the glut coming from?

What has changed to bring on this "glut" is the spectacular increase in US petroleum production - from about 5.5 million barrels per day (mbd) in 2010 to the current rate of 8.4 mbd. The Energy Information Agency expects production to be 13 mbd within five years. Earlier this year we surpassed Saudi Arabia's output to become the world's leading petroleum producer. We will soon surpass our 1970 historical peak of about 10 mbd.

Furthermore, this increase in production is primarily ultra light oil, extracted from shales and dense sandstones, using new fracturing technologies. This oil is not easily distilled in most US refining plants, which were largely built for heavier oils.This exacerbates the coming imbalance between refining capacity and quantity available to be refined.

A secondary contributor to the glut has been the reduction in consumption that occurred with the world-wide recession of 2008, and years following. This reduction in demand further amplifies the effects of the larger supplies.

The export ban

We can't just export any surplus crude. The Energy Policy and Conservation Act (EPCA) of 1975 prohibits it. EPCA was passed right after the crisis created by the OPEC embargo. The objectives were to conserve domestic petroleum supplies and protect the US from vagaries of the international market. The legislation provides that, when warranted by the "national interest", exceptions can be granted on an ad hoc basis, and the President is authorized to lift the ban entirely by executive order.

It is important to note that petroleum products, defined as oil that has been refined to some extent, were not prohibited by EPCA. Therefore, as US production has increased, we have observed a significant increase in exports of those products (now about 3.5 mgd), rather than crude oil itself.

If the export ban is not lifted, the domestic price of crude will fall further and production growth will slow down, but gasoline prices will not fall until investment in refineries and logistics makes larger supplies of gasoline available.

Brent prices have been about $7 above US prices in recent months. Given estimates that we might export a half billion or more barrels per year if the ban were lifted, exports might contribute an additional $50 billion per year to our trade balance, and increase GDP by a half percent (Ebinger, 2014). With stakes this high, you can expect to see increasing pressure on Congress and the President to repeal or lift the ban over the next few months, especially after the elections this fall.

Who would be affected by lifting the ban?

Motorists - In general, lifting an export ban allows domestic price to rise to meet the level of world price. Domestic crude oil price would surely rise, and it might seem that gasoline prices would rise along with it. However, we already export gasoline, so it is priced closer to world markets than crude oil itself, and my view is that it would not be affected so much. Some analysts (Ebinger) even argue that gasoline prices would fall if the ban were lifted.

Oil companies - Clearly the owners of crude oil stocks in the US would benefit from lifting a ban, as their price would rise. However, due to the limits on refining capacity, current refining margins are high by historical standards, and lifting the ban would reduce those margins

Biofuel industry - If gasoline price rises, the price of biofuels will rise. But as noted above, it is notclear that higher petroleum prices would in our current circumstances lead to higher gasoline prices.

Energy security - While this is an ill-defined term, lifting the ban will result in greater domestic crude oil production, which will provide greater energy security for the US. Even if part of that extra production is exported, those exports could be diverted to domestic use in any energy emergency.

Richard K Perrin

Jim Roberts Professor

Agricultural Economics Department

University of Nebraska-Lincoln

402-472-9818

rperrin@unl.edu

References:

Ebinger, Charles and Heather Greenley. 2014. Changing Markets: Economic Opportunities from Lifting the US Ban on Crude Oil Exports. The Brookings Institute, Washington DC.US Energy Information Administration. 2014. Petroleum and Other Liquids http://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_epc0_im0_mbbl_a.htm