By Allan Vyhnalek

While there seem to be no exact statistics, it is anecdotally known — from talking to financial planners, attorneys and other professionals — that about half of our farmers and ranchers have an estate plan completed. Most professionals will indicate, “it is a short half!”

This begs the question: why do we put off estate planning? There seems to be some underlying emotion and thought to this. For quite a few farmers and ranchers, the thought of retiring is likely not something that they want to consider. So, if I’m not retiring, why would I complete an estate plan?

Some studies of farmers from both Iowa and Nebraska show that most never plan to fully retire. One thought is that, if you are not retiring, you don’t need an estate plan. However, preparing for retirement isn’t the only reason to have one. The true purpose of an estate plan does usually not lie in what happens while you are alive, but what happens when you die. The question is: what happens to your “stuff” when you do pass away? Do you want control of what happens when you are no longer here?

We also don’t do an estate plan because it is mentally tough work. Thinking about planning for the estate means that most of us go to a lawyer. As you talk to lawyers, they might go into their legalese language that is hard for some of us to keep up with. They use terms like “probate,” “wills,” “trusts,” “partnerships,” “LLCs,” “buy/sell agreements,” “POD” and “TOD.” These examples are terms and acronyms that we typically do not use daily. This can cause confusion and uncertainty.

In some cases, planning is delayed because we are afraid to make a mistake. We’ve seen others make plans, have something drastically change within the family like an untimely death, divorce or financial crisis, for example, which made the plan they currently have in place unworkable or unfeasible. This causes us to not want to make the plan for fear that something will change. The recommendation is to have a plan in place. Then if there is a change that makes the current plan untenable, you can simply change it. This will cost money, but not nearly as much as having no plan, or a plan that won’t work for your situation.

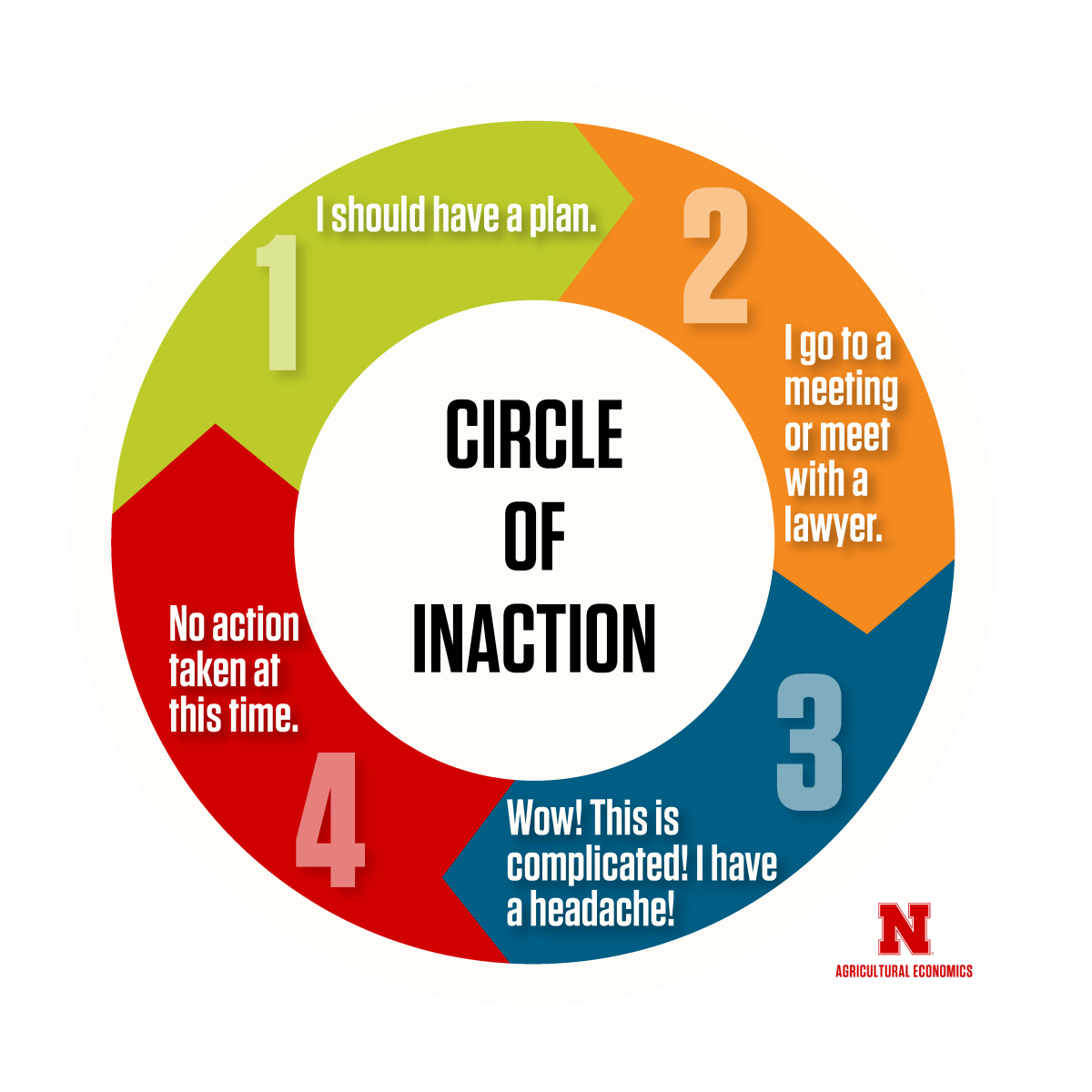

Because of the reasons that are outlined here and others, a “circle of inaction” is created when trying to develop your plan. Let’s talk about that circle.

Step one: You realize that you need an estate plan. If you are reading this article, you have probably already realized this need.

Step two: After deciding to start the process of developing a plan, you quickly realize that you need more information. So, you to go to a meeting about estate planning, and/or meet with a lawyer. Everyone is pretty good about getting this step done.

Step three: You’ve taken the leap into the planning process, but you realize that this is hard and more complicated than predicted; it is giving you a headache to just think about this. Most farmers and ranchers are programed to think about the next production step. Things like what fertilizer rate, what bull for breeding, when to apply herbicide, what herbicide — those kinds of questions. Thinking about death and about what happens to our stuff is not as clear or as urgent as production decisions. There is not a “one-size-fits-all” process, especially for multi-generational operations.

Step four: Sometime in the decision-making process, thinking about the estate plan was so unpleasant, that you just stop, or take no actions at this time. The dilemma of being stuck in neutral and not deciding can last from three months to three years, or longer. The crazy part is that most will circle back to step one, two and three only to end up stuck in step four again.

It is simply recommended that you get an estate plan done. Research indicates that for many families, planning is delayed until there has been a critical life event which forces the family to address the matter. Examples would be loss of life from an accident, stroke, heart attack; or it will be life changing diseases like Alzheimer’s, cancer, or Parkinson’s. Some members of the family will still have sound decision-making when there is a crisis. Others don’t do as well, and the crisis affects decision-making. Get a plan in place ahead of this catastrophic event, when there isn’t the added stress.

The correct planning should be done in five steps:

1) A plan is needed.

2) There is a need to go to a meeting and/or meet with a lawyer.

3) Family members are consulted to know what their wishes are.

4) Decisions are made and plan is developed.

5) Plan is implemented with documents signed. Remember, most estate plans can be changed if needed.

You probably will not get through the five steps listed above in three weeks or less. You can set a goal to get this done in three to six months. Get started now. Most clients who attend estate or succession planning meetings leave the meeting saying something like: “I just wished I would have started this process 10-15 years ago.”

Contact

Allan Vyhnalek

Extension Educator for Farm and Ranch Succession

Department of Agricultural Economics

402-472-1771

avyhnalek2@unl.edu

agecon.unl.edu/succession

303C Filley Hall

Lincoln, NE 68583-0922

Nebraska FARMcast

Nebraska FARMcast

Episode 1: Why Don't We Have an Estate Plan?