Cornhusker Economics Nov 8, 2023

Will Nebraska Farms and Ranches Be Ready for Double Digit Operating Line Rates?

By Jeffrey Stokes and Jim Jansen

For those involved in agriculture, it has been quite a while since interest rates on farm real estate, equipment, and operating lines have been as high as they are for the industry. As the fall harvest winds down and producers focus on next year, interest rates on operating lines may cause shock. It has been over 20 years since interest rates on operating lines exceeded 10%. To better understand what may be causing interest rates on operating lines to rise, it will be beneficial to understand some basic monetary policy tools the Fed has at its disposal. The tool receiving heavy attention of late, and the one (often incorrectly, but) frequently reported on by the media, is the fed funds rate.

In the context of the United States financial system, the term “fed funds” typically refers to either the federal funds market or the federal funds rate, which could be a target rate (technically a range) or an effective rate. When referring to the market, it is the digital system whereby depository institutions with excess reserves lend funds to other institutions with a shortfall in their reserves, typically on an unsecured, overnight basis. The effective rate is a calculated volume-weighted median of overnight federal funds transactions reflecting the interest rate that depository institutions lend to one another. In simpler terms, the effective fed funds rate is the effective interest rate at which banks borrow and lend money to each other overnight in the fed funds market.

Commonly misreported by the media, interest rates are not set by the government or the Federal Reserve. Rather, the fed funds target rate is used to implement monetary policy. Adjusting the target rate can affect borrowing costs for consumers and businesses. For example, raising the target rate is designed to cool down spending and reduce inflation when the economy grows too quickly. The target rate has been adjusted upward aggressively over the last year or so as the Fed seeks to rein in inflation. Changes in the target rate can and have had a cascading effect on the broader economy. When the target rate is increased, interbank borrowing becomes more expensive, which can have the effect of slowing down consumer spending and business investment.

The Federal Open Market Committee (FOMC), which is part of the Federal Reserve System, sets the target rate for the effective fed funds rate. As of October 2023, this target rate is between 525 and 550 basis points. A basis point is 1/100 of a percent, translating to a target rate of 5.25% and 5.50%. Since March of 2022, when the fed funds target rate was 0-25 basis points, 10 increases between 25 and 75 basis points resulted in the current 525-550 target rate. At its most recent meeting in September, the FOMC left unchanged the target rate while intimating that there could be one more increase this year. As we’ll see below, the markets are skeptical of further increases this year and suggest eventual rate decreases beginning next year.

The FOMC does not force banks to lend and borrow at the effective fed funds rate, but rather, banks negotiate the rate between themselves, and the effective fed funds rate is then simply a calculation of the volume-weighted median of overnight federal funds transactions. Effective fed funds rates are published daily for the preceding day. The process of buying and selling government bonds, called Open Market Operations (OMOs), is a way in which the Fed can move interest rates toward the target rate. The Trading Desk at the Federal Reserve Bank of New York is responsible for conducting OMOs. For example, to raise the effective rate in response to an increase in the target rate, the Trading Desk can sell government securities in the open market. This decreases the supply of reserves in the banking system and puts upward pressure on the rates banks negotiate and hence the effective federal funds rate. Since most interest rates tend to be highly positively correlated, the prime rate and interest rates for operating lines, mortgages, and savings accounts generally also increase. Overall, the federal funds target rate, effective rate, and the associated fed funds market play a crucial role in the functioning of the U.S. financial system and have a significant impact on the broader economy.

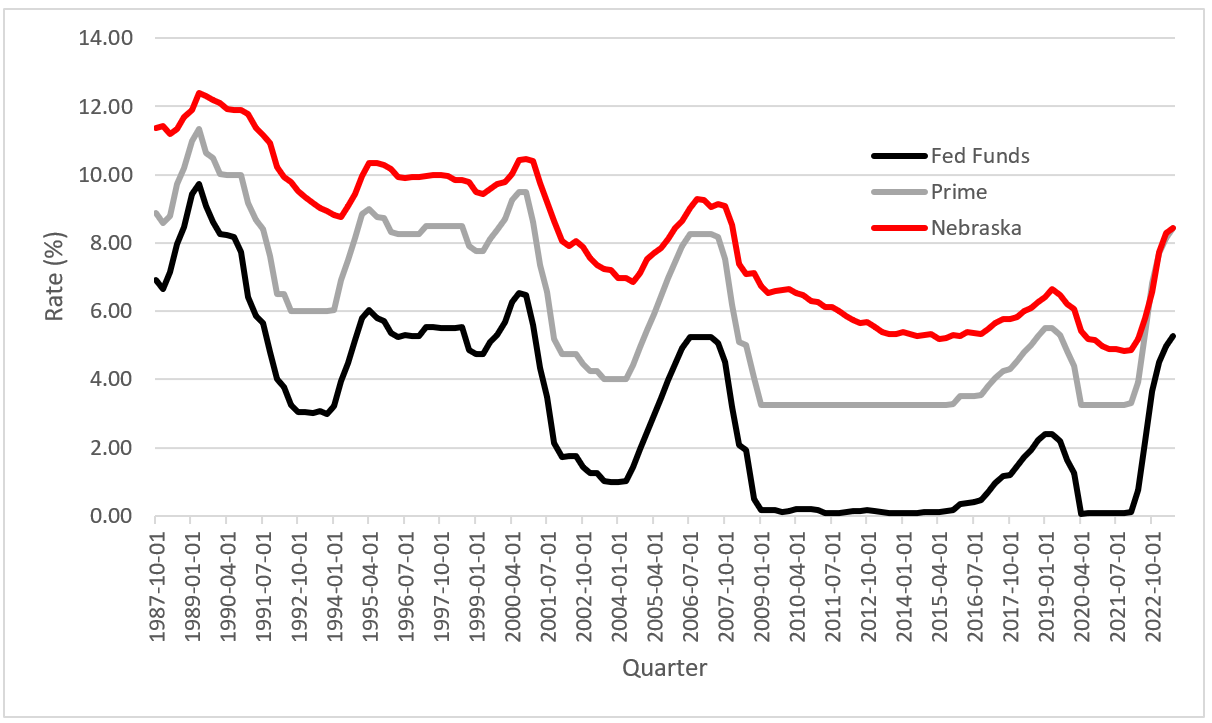

Shown below in Figure 1 is the effective fed funds rate for each quarter from the third quarter of 1987 through the second quarter of 2023. Also shown for comparison purposes are the quarterly prime rate and the average operating line rate from Nebraska banks surveyed by the Federal Reserve Bank of Kansas City (10th Federal Reserve District). [1]

Clearly, the three series are positively correlated as they generally move together. In fact, the estimated correlation coefficient between the effective fed funds rate and the prime rate is near-perfect positive at +0.994. The estimated correlation coefficient between the effective fed funds rate (prime rate) and the average rate charged on operating lines in Nebraska is +0.943 (+0.933). While there may be a more direct economic connection between the prime rate and the interest rate charged for operating lines, the strength of the correlation between the effective fed funds rate and the prime rate suggests that both series convey similar information. However, as noted above, the effective fed funds rate is the monetary policy tool and as shown below, the available market information on future effective fed funds rates is far superior to the prime rate.

The average spread between the effective fed funds rate and Nebraska operating line rates is 4.93%, with a standard deviation of 0.94% and a range of 2.47% to 6.60% over the sample period. Using the most recent quarterly estimate (2023.Q2) for the effective fed funds rate of 5.26% suggests an average operating line rate of 5.26% + 4.93% = 10.19%. However, it should be noted that the average rate for Nebraska operating lines in 2023.Q2 was actually 8.45%, while the 10th District overall average was 8.52%. Even so, with the effective fed funds rate having increased since the 2nd quarter of this year, it is easy to see how operating line rates could exceed 10% in the spring.

Further evidence favoring higher operating line rates in the spring of 2024 can be found by examining the CME FedWatch Tool [2]. There is an active market for fed funds futures contracts, and the CME FedWatch Tool shows price and volatility information related to those futures contracts. More importantly, the futures contracts are an important conduit between market participants interested in hedging or speculating in the fed funds futures market and the actions of the FOMC related to the fed funds target rate. Target rate probabilities can be inferred from the fed funds futures prices and indicate market participants’ assessment of the likelihood of target rate changes at future FOMC meetings.

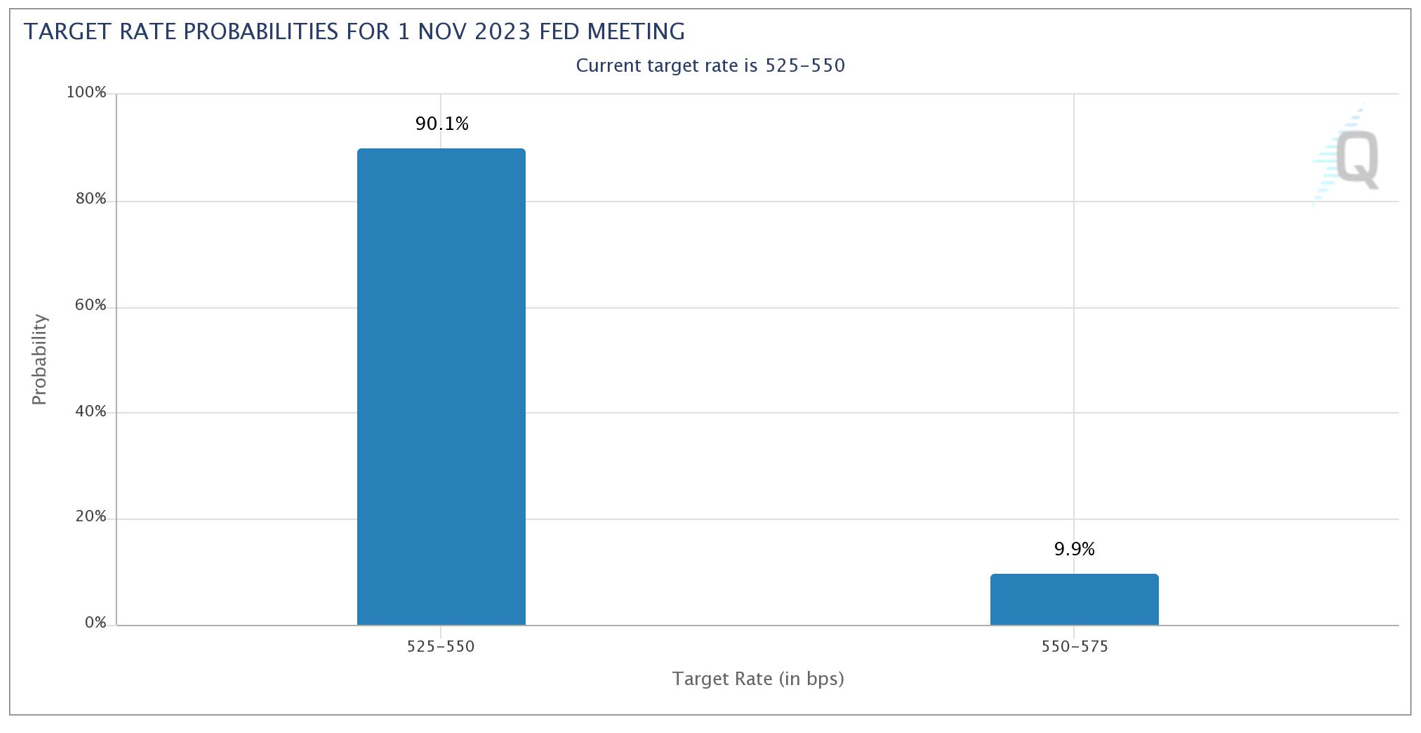

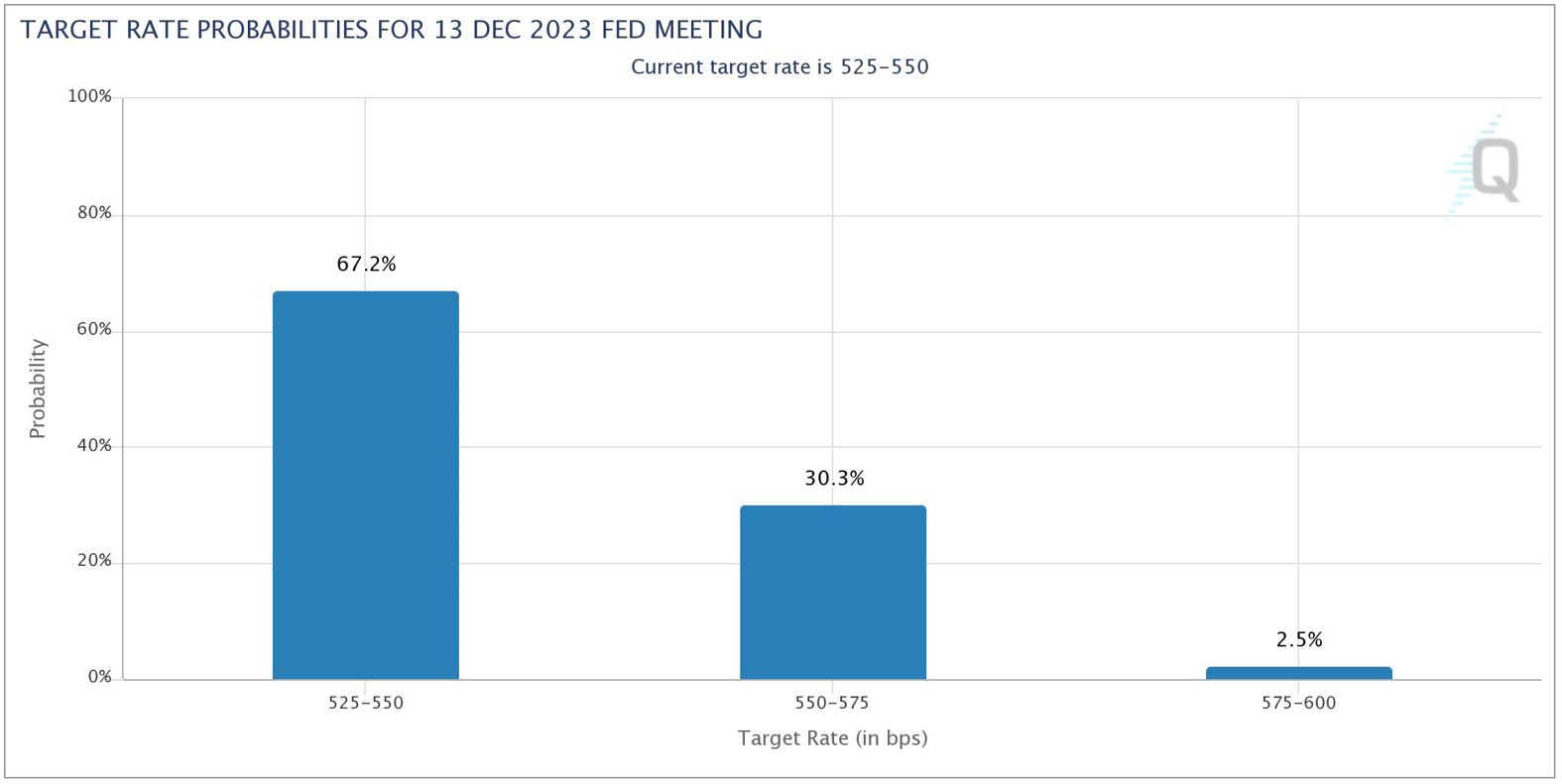

Shown in Figures 2 and 3 are probabilities of target rate changes as of October 16, 2023. Figure 2 is specific to the upcoming FOMC meeting on November 1, 2023, while Figure 3 is specific to the last calendar meeting of the FOMC for the year on December 13, 2023.

Figure 2. Probabilities of fed funds target rate changes at the 11/1/23 FOMC meeting.

As shown in Figure 2, the market mainly anticipates that the FOMC will not raise the target rate from the current 525-550 basis points, as indicated by the 90.1% probability. However, since the FOMC had signaled the possibility of one more target rate increase this year, market participants have assigned a 9.9% probability of a 25-basis point increase at the November meeting. Using the mid-point of the target ranges and weighing by the indicated probabilities, the fed funds futures market is suggesting that a 0.901×537.5 + 0.099×562.5 = 539.975 = 5.40% effective fed funds rate is likely, which is within the 525-550 target range.

Figure 3. Probabilities of fed funds target rate changes at the 12/13/23 FOMC meeting.

Shown in Figure 3 is similarly interpreted information but for the December 13, 2023, FOMC meeting. Here, market participants are still reasonably confident that after the December FOMC meeting, the target rate will be 525-550 (67.2%), but a target rate of 550-575 (30.3%) or, a target rate of 575-600 (2.5%) are also possible. Calculating the expected value as before yields: 0.672×537.5 + 0.303×562.5 + 0.025×587.5 = 546.325 = 5.46%, higher than the November estimate and near the upper end of the current target range. Of course, in the end, the FOMC either raises the target rate by a discrete amount, or they don’t, but the calculations still have value for understanding what the market is anticipating given current information. It is also important to point out that there are traded futures contracts and therefore probability distributions for FOMC meetings through 2024 (not just November and December of 2023). In addition, the probabilities change daily as information about the economy becomes available and is used by traders to affect fed funds futures contract prices.

One of the challenges of making sense of the probabilities reported by the CME FedWatch Tool is that the probabilities are unconditional. For example, the probability of a 550-575 target rate in December is consistent with two possible FOMC actions: (1) a 25-basis point target rate increase in November followed by no change in the target rate in December, or (2) no change in the target rate in November followed by a 25-basis point increase in the target rate in December. The unconditional probabilities do not distinguish between the two FOMC actions.

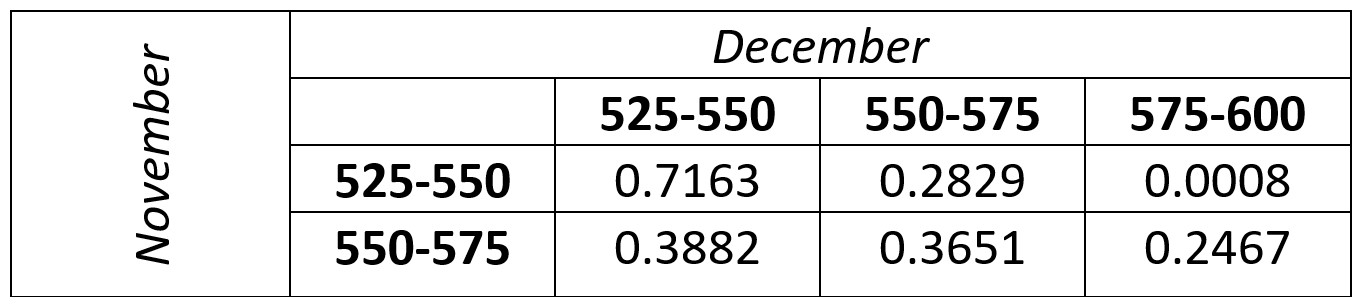

Although not reported by the CME FedWatch Tool, conditional probabilities can be estimated from the target rate probabilities and likely convey more useful information. As the name implies, the conditional probability indicates the probability of a target rate increase in the future conditional on some target rate today. As an example, from Figure 2 there are two possible target rates in November (525-550 and 550-575), and from Figure 3, there are three possible target rates in December (525-550, 550-575, and 575-600). This implies there are a total of six conditional probabilities in the November to December transition. While the estimation of these probabilities is beyond the scope of this article, shown in the table below are the six estimated conditional probabilities specific to the November 2023 to December 2023 transition.

Table 1. Conditional probability of fed funds target rate changes.

For example, the probability of no change in the target rate in December conditional on no change in the target rate in November is 71.63%. The remaining probabilities can be interpreted analogously. Worth pointing out is the miniscule probability (0.08%) of a 50-basis point increase to 575-600 in December conditional on an unchanged target rate in November. However, the probability of seeing a 575-600 target rate in December conditional on a 25-basis point increase in November is considerably larger at 24.67%. Apparently, the market feels that increases tend to beget further increases.

Adding the average spread between the effective fed funds rate and Nebraska operating lines discussed above (i.e., 4.93%) to the two expected values calculated above yields a November Nebraska operating line rate of 5.40% + 4.93% = 10.33% and a December rate of 5.46% + 4.93% = 10.39%. A similar calculation for January and March (not shown), when most operating lines are secured, suggests rates of 10.41% (January) and 10.35% (March). There is no fed funds futures contract traded for February because the FOMC does not meet in February. Currently, it is possible that the highest operating line rates may occur in January. Regardless, a good rule of thumb may be to add about 5% to the current fed funds target rate when estimating interest rates on operating lines. This implies that as of October 2023, rates on operating lines would be 10.25% to 10.50%, give or take.

Farmers and ranchers facing higher interest expenses on their operating lines may consider different strategies when acquiring inputs for the upcoming growing season. Policy moves made by the Federal Reserve to maintain the current target rate will likely keep higher interest rates on operating lines. Current interest rates on operating lines will likely exceed the rates many operators have become used to over the last 15 years. The future direction the FOMC takes on the target rate will likely be tied to the future direction of the national rate of inflation and unemployment.

[1] The 10th Federal Reserve District includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico, and the western third of Missouri.

[2] Available at https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html