Cornhusker Economics May 31, 2023

They Shrank the Futures Contracts! Mini Futures Contracts: What They Are and How To Use Them

Mini futures contracts (or e-mini, since they are traded electronically) were first developed in the late 1990s based on futures contracts that already existed. The main characteristic of mini contracts is that they represent a fraction of standard-size contracts. For example, the first mini contract was launched in 1997 and based on the S&P500 futures contract. The size of the standard futures contract is $250 times the value of the S&P500 index, while the size of the mini futures contract is $50 times the value of the S&P500 index. If the index is at 4,200 points, the total value of the standard contract is $1,050,000 and the total value of the mini contract is $210,000, i.e., the mini contract, in this case, corresponds to 1/5 of the size of the standard contract.

Why were mini futures contracts created?

Since the first mini contract was created for equity indexes, they have expanded to more assets including other equity indexes, currencies, and commodities. The main reason for the development of these contracts was to make futures trading more affordable and accessible to a larger population of traders and investors.

As we saw above, the standard S&P500 futures contract became very expensive for the ‘average’ trader or those who are still starting or have limited funds. Since the value of the contract is based on the value of the S&P500 index, the contract will become more and more valuable as the value of the S&P500 index increases. At 1/5 of the value of the standard contract, the mini contracts become much more accessible. Even though traders don’t really trade the actual value of the contract, they have to make initial margin deposits and possibly handle margin calls. Initial margin deposits are based on the total value of the contract, hence mini-size contracts will require smaller margin deposits.

The risk exposure for speculators is also smaller with mini contracts. If the S&P500 index changes by 1 point, a trader with a position in the standard-size futures contract can lose $250/contract while a trader with a position in the mini-size futures contract can lose only $50/contract.

The main reason for futures exchanges to develop more affordable and accessible contracts is to encourage more people to trade. Futures exchanges want people to trade their products because more trading generates more revenue. The CME Group and other exchanges are corporations that provide a service, namely a marketplace for hedgers, speculators, and investors to trade different types of assets using futures and options contracts. These corporations charge fees for traders to use their marketplace, thus more trading activity means more fees and hence more revenues. Typically, trading fees are a major component of exchanges’ total revenue.

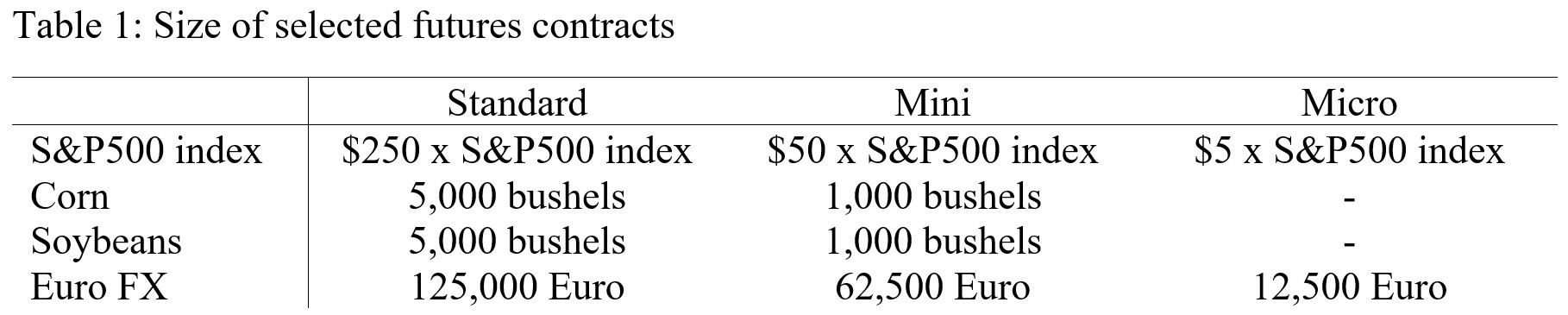

These contracts became so widely traded for equity indexes that even smaller contracts were created (they shrank them even further!). As we mentioned earlier, the mini futures contract on the S&P500 index was created in 1997. It eventually became very popular, and the futures exchange decided to create another contract, the micro futures contract, which is 1/10 of the size of the mini contract and 1/50 of the size of the standard contract. Futures exchanges have taken the extra step of reducing the size of some contracts even more and micro contracts have been developed for other assets as well. We can see in Table 1 some examples of mini and micro futures contracts on the S&P500 index, corn and soybeans (which don’t have a micro contract), and the Euro/US$ exchange rate (Euro FX). Again, the main purpose of developing smaller contracts is to facilitate trading for a larger population of traders and investors, and then generate more business for the exchanges.

How popular are mini and micro futures contracts?

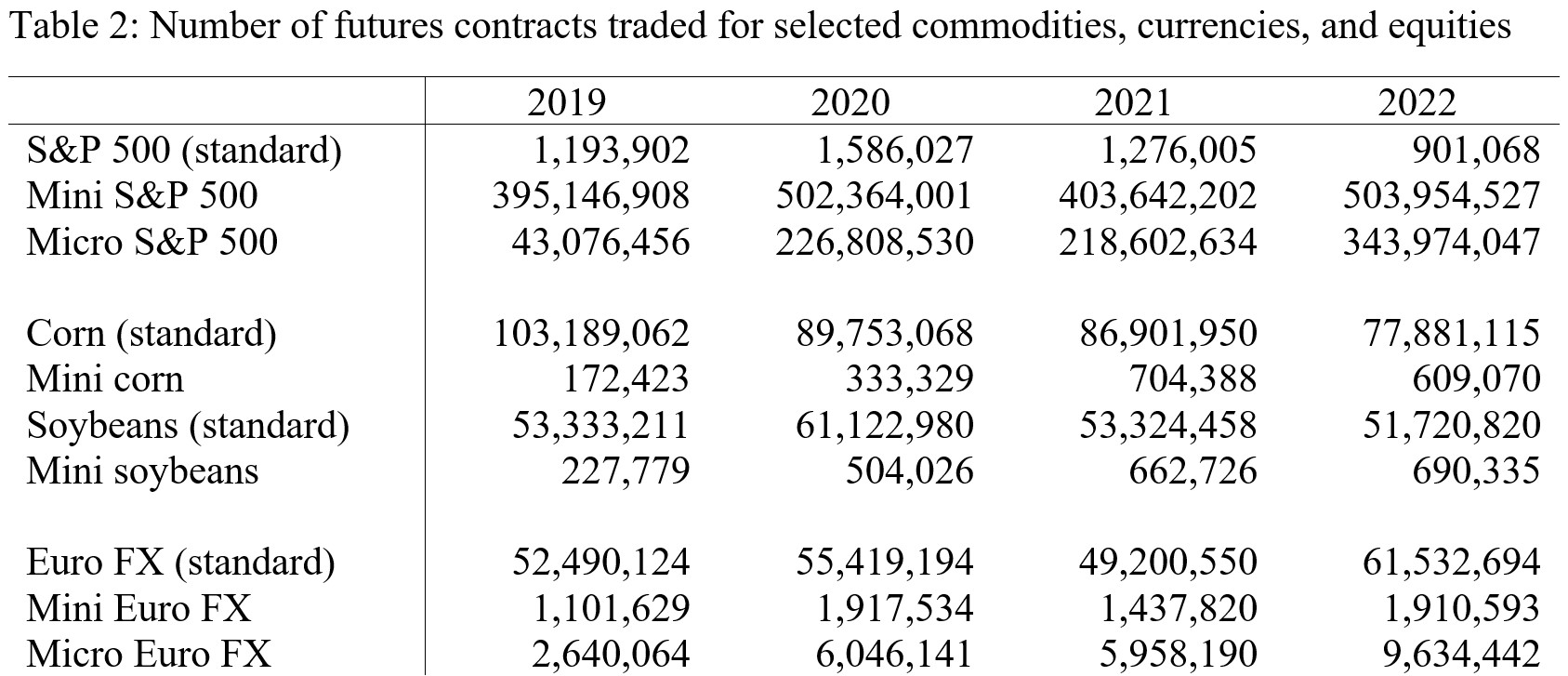

The trading of mini and micro contracts varies across asset classes. They are most popular and largely traded among equity indexes, but not nearly as much among commodities and currencies, for example. Table 2 shows the number of futures contracts traded for the S&P500, corn, soybeans, and the Euro/US$ exchange rate (Euro FX) across contract sizes in the last 4 years. For the S&P500, mini and micro contracts have taken over most of the trading volume and become much more popular than the standard-size contract. In fact, the mini and micro contracts for the S&P500 became so popular that the futures exchange decide to delist its standard-size contract as of September 2021. A few contract months for the standard-size contract are still being traded because traders already had open positions in those months when the contract was delisted, but eventually, there will be no more trading in the standard-size S&P500 futures contract.

As opposed to equity indexes, mini- and micro-size contracts are not as popular for other asset classes. For corn and soybeans, the trading volume for mini-size contracts has been equivalent to 1% or less of the trading volume for the standard-size contract. For the Euro/US$ exchange rate, the trading volume for mini- and micro-size contracts combined has been approximately 15% of the trading volume for the standard-size contract (Table 2).

Can mini and micro futures contracts be used for hedging and speculation?

Yes, mini and micro futures contracts can be used for hedging and speculation in the same way as standard-size contracts. The contract specifications and the trading of these contracts are mostly the same compared to standard-size contracts, with the main difference being really the size of the contracts (i.e. the quantity of the underlying asset being traded).

Hedgers use futures contracts to gain protection against undesired price movements, while speculators use these contracts to speculate on price changes and profit from them. The ability to do that using mini and micro contracts as effectively as they do with standard-size contracts depends, to some extent, on how futures price behaves for each contract. In principle, since the underlying asset is the same across contract sizes, the futures price should be the same regardless we are looking at the standard-, mini- or micro-size contracts. Figure 1 shows an example of the corn futures price for December 2023 delivery under the standard-size contract and the mini-contract since the beginning of the year. As we can see, price levels and price behavior over time are essentially the same between the two contracts. At any given point in time, there can be small differences in futures prices across contract sizes depending on trading activity, but the general price behavior is mostly the same.

Figure 1: Corn futures prices for December 2023 delivery – standard-size contract (left) and mini-size contract (right), US$/bu

What are the pros and cons of using mini and micro futures contracts for hedging?

One of the advantages of mini and micro contracts, as we discussed earlier, is their affordability and accessibility. With smaller sizes come smaller margin deposits. Using the corn futures contract as an example, we would have to make an initial margin deposit of $1,980/contract if we traded the standard-size contract (5,000 bushels). If we traded the mini-size corn futures contract instead (1,000 bushels), our initial margin deposit would have been one-fifth of that, i.e., $396. Another example: the initial margin deposit for the mini S&P500 contract is $12,320/contract, but only $1,232/contract if we trade the micro-size contract. In addition, in some cases, trading fees can be smaller for mini and micro contracts as well.

Another advantage is flexibility. Smaller-size contracts give traders more options for the quantity they want to trade. For example, with the standard-size corn futures contract, traders can trade corn in increments of 5,000 bushels. One can trade 15,000 bushels of corn (3 contracts) or 20,000 bushels of corn (4 contracts), for example, but we can’t trade 17,000 bushels of corn using the standard-size contract. The smaller size of the mini and micro contracts allows more flexibility in those cases.

However, there is a significant disadvantage of mini and micro contracts for most markets, which is liquidity. As we discussed earlier, with the exception of equity indexes, trading volumes in most mini and micro contracts are much smaller than they are for standard-size contracts. Limited liquidity can make it harder for traders to enter and exit the market when they want, as well as to trade the quantities that they want. Both for hedgers and speculators, the ability to quickly enter and exit the futures market can be the difference between making money and losing money with their hedges and their trades.

We can use the corn futures market to illustrate this point. Figure 2 shows daily trading volume since the beginning of the year in the corn futures contract for December 2023 delivery. The chart on the left shows trading volume in the standard-size contract while the one on the right shows volume for the mini-size contract. The magnitudes of trading volume across contract sizes calls our attention right away. Between 1/3/23 and 5/18/23, almost 4 million standard-size contracts were traded (daily average of almost 42 thousand contracts), but only about 6.5 thousand mini-contracts were traded during the same period (daily average of 70 contracts). On their slowest days, standard-size contracts would still trade around 8 thousand to 10 thousand contracts. On slow days for mini-size contracts, only around 10-15 contracts would be traded. Therefore, on some days it can be especially challenging to easily enter or exit the futures market or trade the quantities that we want if we are trading mini or micro contracts.

Will mini and micro futures contracts become more liquid for all asset classes? There is an old adage in the futures market that says that liquidity begets liquidity. Many mini and micro contracts have relatively low trading volumes because not many traders want to trade them, and not many traders want to trade them because they have low trading volumes. Normally, this cycle is broken when there is a structural change in the market, or the “new” contract fulfills a specific need. For example, the mini and micro contracts for equity indexes (such as the S&P500) gained popularity because the standard-size contract eventually became too expensive for many traders, who then started looking for more affordable instruments that allowed them to still trade equity indexes. For commodities and currencies, on the other hand, there doesn’t seem to be any similar event on the horizon that would drive traders to smaller-size contracts. Therefore, despite some advantages that they have compared to standard-size contracts, it doesn’t seem that mini and micro contracts will become extensively traded across all asset classes in the near future.

Fabio Mattos

Associate Professor

Department of Agricultural Economics

University of Nebraska-Lincoln

fmattos@unl.edu

402-472-1796